Vancouver, British Columbia (April 20, 2011) – New Pacific Metals Corp. (TSXV: “NUX”) (“New Pacific” or the “Company”) is pleased to report its progress for the Tagish Lake Gold Property on permitting, and planned 2011 exploration and drill program.

Permitting

For its Tagish Lake Gold Property, the Company is currently operating under a Class III permit, which expires on October 11, 2011. The current Class III permit allows the Company to complete surface drilling on the property and underground drilling at the Skukum Creek deposit. The Company has completed a renewal application for a Class III permit, and completed the documents related to the environmental assessment for the renewal, and is in the process of submitting these documents to the Yukon government for approval.

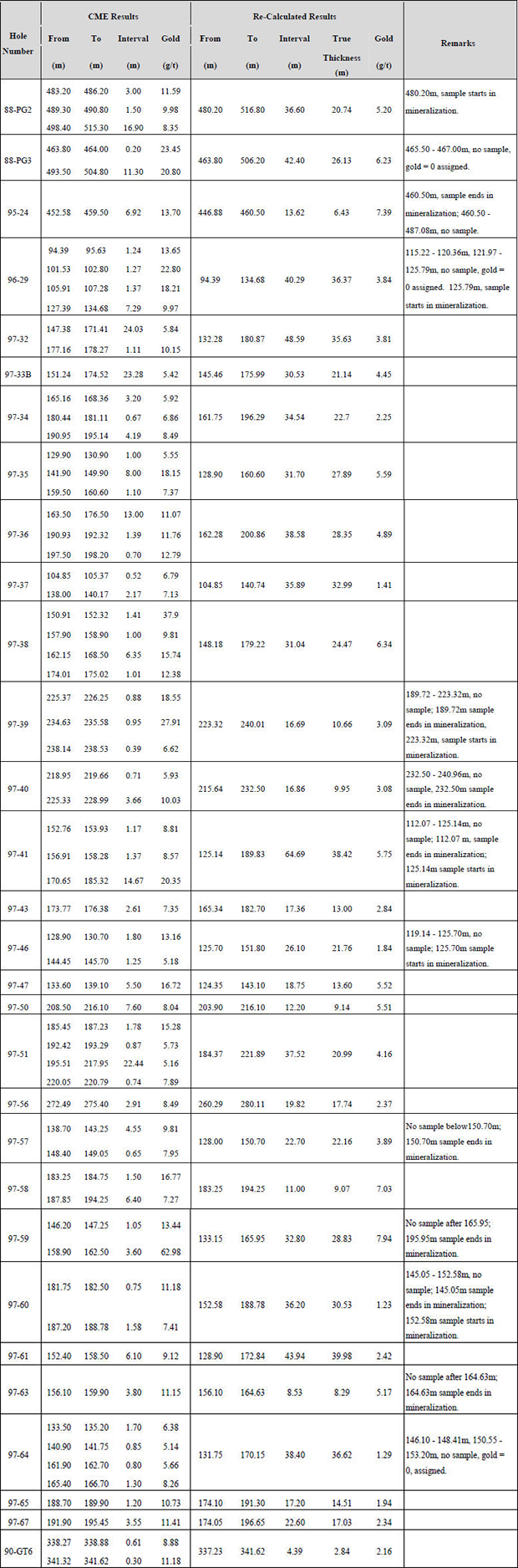

As reported in the Company’s January 13, 2011 press release, significant drill intercepts were identified at the Goddell site of the Tagish Lake Gold Property based on the historical underground drilling results; e.g., drill hole 97-41 intercepted 64.69 metres grading 5.75 g/t gold. Underground drilling from the Goddell decline is the first priority for the Company’s 2011 drilling program. Therefore, the Company has submitted to Yukon government officials for their approval, a Goddell Portal de-watering “Notice of Work” and an amendment to the Class III permit for the Goddell Portal underground drilling program, which also includes an expansion of the camp facility from 25 to 50 people.

The Company has engaged an environmental consulting company to complete an environmental assessment gap analysis in preparation for a full environmental assessment study for a possible mining license at the Skukum Creek and Goddell sites. The Company is also in the process of consultation with the First Nations regarding current and future activities.

The Goddell Portal de-watering and rehabilitation

At the Goddell site, a decline 780 metres long, 3.5 metres by 4.0 metres, was developed from the surface at the 1,015-metre elevation to provide access for underground drilling in 1996. By 1997, a total of 9,242 metres of underground drilling in 40 holes was completed from the Goddell Portal, which was subsequently flooded. In order to test our new geological model for the Goddell Project (see January 13, 2011 press release), the Company intends to continue underground drilling from the Goddell Portal.

Over the last two months, the Company has cleared the access road, acquired necessary equipment and supplies, installed a power generator, and recruited four technical staff for the de-watering. The equipment purchased includes generators, a front end loader, dewatering pumps, ventilation, electrical equipment, and underground mine equipment to excavate the new drill stations and to complete future development work.

With the “Notice of Work” filed with government authorities, Goddell Portal is currently being dewatered and the water level has been lowered markedly from the entrance of the portal since the de-watering started about 10 days ago. Based on the dewatering rate of 290 cubic metres per day, it is anticipated that the portal will be completely dewatered on or about June 15, 2011.

Once de-watered, the portal will be rehabilitated and eight new drill stations will be developed along the 780 metre long decline in addition to the five existing stations. Based on the current de-watered portion of the portal, the rock stability situation is robust and it is anticipated that minimum ground support and rehabilitation is required. The Company has filed for an explosives permit with the Yukon government to allow for underground blasting. Underground drilling is expected to commence in early July and can be carried out year around.

Once the Goddell Portal de-watering is completed, the Company intends to de-water the Skukum Creek Portal in preparation for underground drilling from that Portal.

Camp expansion

The expansion of the camp from 25 to 50 persons is nearing completion with the installation of services currently being undertaken. Power is being supplied from a new 180 kW generator that has been purchased to supply both the camp and the geology building which will house the core cutting and mapping facilities as well as the geological team’s offices. The offices will be furnished with new plotting and computer modeling equipment to support the Company’s surface and underground drill program.

2011 exploration and priority drilling targets

Once dewatering is completed and weather permitting, the Company will start an underground and surface drilling program totalling about 60,000 metres.

For the Goddell site, the Company has planned about 23,000 metres of underground drilling from the Goddell decline for 2011 to test the “merged” zone (where the G.G. and P.D. zones merge) and gold mineralization intensifies with mineralized intervals over 30 metres. The up-dip extension of the P.D. zone will also be tested.

At the Skukum Creek site, located at about six kilometres southwest from the Goddell Portal, 13,000 metres of underground drilling is planned to target depth extensions of four mineralized zones where historical drilling has only focussed on portions of the four mineralized zones and only to about 300 metres from the surface.

For the Raca site, located along the structural extension of the Skukum Creek mineralization zones (Rainbow Zone) to the northeast, 5,500 metres of surface drilling is planned to test extension of the known historical drilling and surface gold anomalies. The drill hole Raca 97-1, located about 500 metres northeast of the Rainbow zone of the Skukum Creek Project, intercepted 3.6 metre grading 2.66 g/t gold and 561 g/t silver. At the surface, soil gold anomalies outlined before 1998 by a previous owner, (all associated with anomalous values of silver and base metals), extend over two kilometres along a northeast structure hosting rhyolite dykes, with peak values up to 1000 ppb gold. Based on a 1986 geological report by West Mount Resources, several surface chip samples over >10 metres wide returned over 1 g/t gold and one composite chip sample returned 20 metres grading 4 g/t gold and 19.9g/t silver.

In addition, several other regional gold-silver targets have been planned for about 18,500 metres of surface drilling, including the Charleston gold-silver showing, a surface extension of the Goddell mineralization zone, and a copper-molybdenum anomaly at the Porter alteration structure zone.

The Company is also expanding its land holding by currently staking the area surrounding its existing land position.

About New Pacific Metals Corp.

New Pacific is engaged in the exploration and development of mineral resources in Canada. The Company’s strategy is to focus on projects that can be developed in a relatively short time into high-margin production with reasonable development capital profiles, even before the full resource potential of the properties are defined. Accordingly the future exploration and production expansion can be funded from the cash flow.

For Further Information:

New Pacific Metals Corp.

Investor Relations

Phone: +1 (604) 633-1368

Fax: +1 (604) 669-9387

Email: info@newpacificmetals.com

Website: www.newpacificmetals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.