Carangas Project

Preliminary Economic Assessment

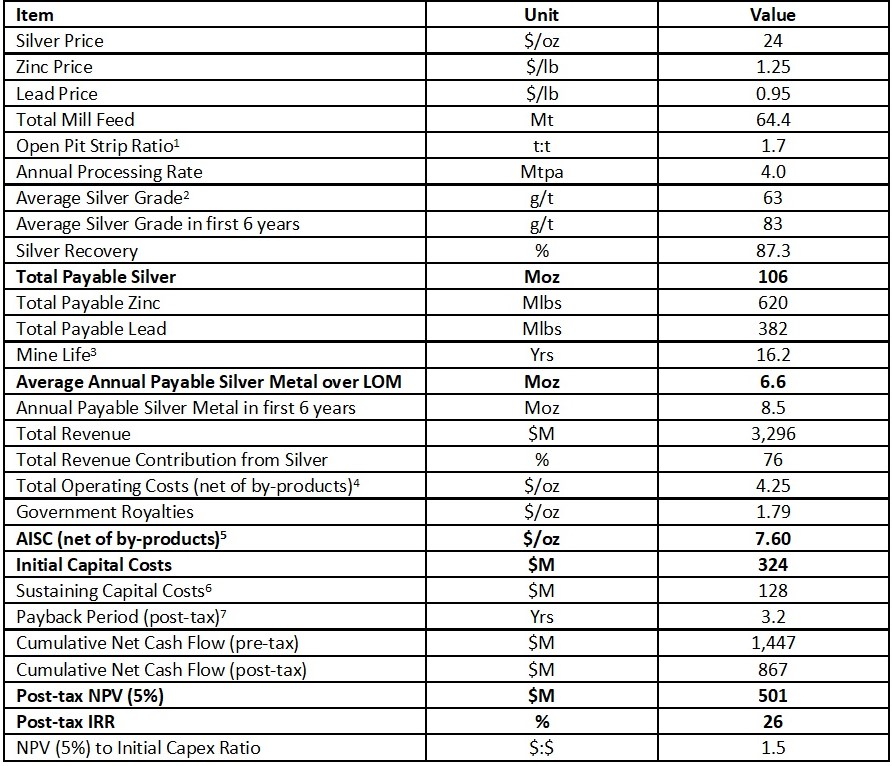

On October 2, 2024, the Company released the inaugural Preliminary Economic Assessment (“PEA”) results for the Carangas Project in Oruro Department, Bolivia (the “Project”). The PEA outlined a robust, high-margin operation focused on a discrete, near-surface subset of silver-rich material. The 16.2-year mine plan envisions a conventional open-pit and sulphide flotation operation at Carangas, which will produce an average of 6.6 million ounces (“Moz”) of silver, 17 thousand tonnes (“kt”) of zinc, and 11 kt of lead, at an all-in sustaining cost (“AISC”) of $7.60/oz net of by-products.

The PEA is based on the Mineral Resource Estimate (the “MRE) for the Project, which was reported on September 5, 2023 and is reported in accordance with National Instrument 43‐101- Standards of Disclosure for Mineral Projects (“NI 43‐101”).

PEA Highlights ($ figures in USD):

- Base Case post-tax net present value (“NPV”) (5%) of $501 million and internal rate of return (“IRR”) of 26% at a base case price of $24.00/oz silver, $1.25/lb zinc, and $0.95/lb lead

- NPV and IRR of $748 million and 34%, respectively, at $30/oz silver,

- 16-year life of mine (“LOM”), excluding 2-years of pre-production, producing approximately 106 million oz (“Moz”) of payable silver, 620 million pounds (“Mlbs”) of payable zinc and 382 Mlbs of payable lead,

- Payable silver production of approximately 8.5 Moz per year in years one through six, with LOM average silver production exceeding 6.5 Moz per year,

- Initial capital costs of $324 million and a post-tax payback of 3.2 years,

- Average LOM all-in sustaining cost (“AISC”) of $7.60/oz silver, net of by-products, and

- Approximately 500 direct permanent jobs to be created from the Project.

Carangas Open Pit Mining – Key Economic Assumptions and Results

- LOM average strip ratio.

- LOM average.

- Excludes 2 years pre-production period.

- Includes mining costs, processing costs, tailing costs, G&A costs, and selling costs.

- Includes total operating costs, royalties, sustaining capital costs, and closure costs.

- Excludes mine closure costs of $39 M.

- The payback period is measured from the beginning of production after construction is completed.

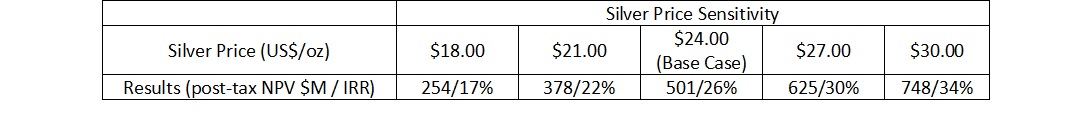

Carangas Project Economic Sensitivity Analysis for Silver Prices – Post-Tax

Note: Inputs for the base case (100%) are listed in Table 1. Table 2 presents how the Project’s post-tax NPV and IRR are affected by varying the selling price of silver. For example, if the silver price increases by $3/oz (from $24.00 to $27.00/oz) while other Inputs remain as the “Base Case”, then the NPV becomes $625 M and the IRR is 30%. NPV values are discounted at a rate of 5%. Zinc and lead prices are kept constant at $1.25/lb and $0.95/lb respectively.

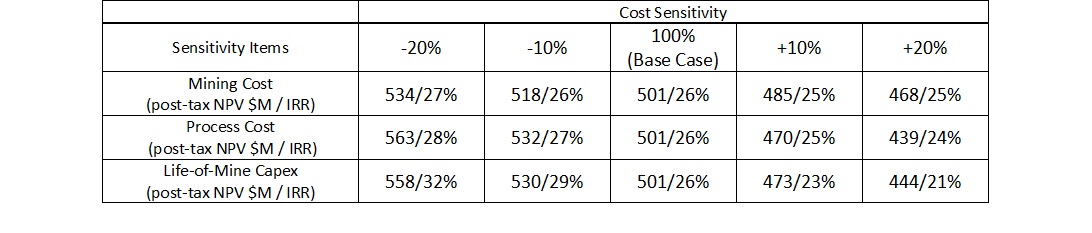

Carangas Project Economic Sensitivity Analysis for Costs – Post-Tax

Note: Inputs for the base case (100%) are listed in Table 1. Table 3 lists sensitivity analysis for three “Input” variables. For example, if LOM Capex increases by 20% (+20%), while silver price, mine operating cost, and process operating cost remain the same as the “Base Case” input, the NPV becomes $444M and IRR is 21%. NPV values are discounted at a rate of 5%.

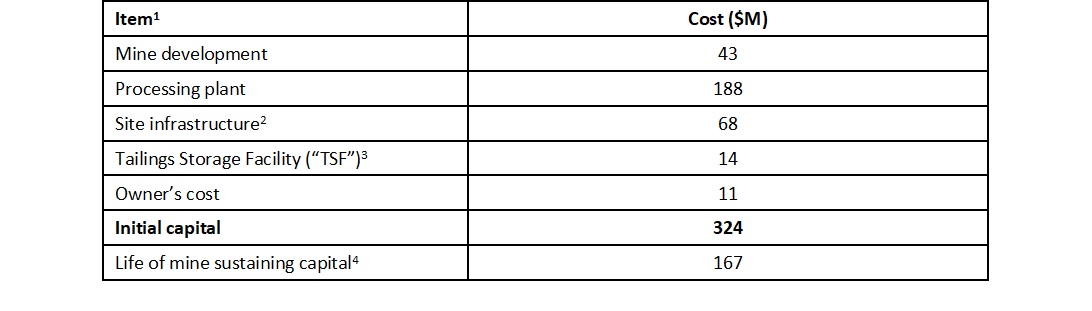

Total Capital Cost Estimate

Note

- Includes direct, indirect, and contingency costs. Contingency costs total approximately $43 M.

- Includes $37 M for a 200km 115 kV power line.

- Tailings capital includes initial earthworks, liners/membranes, and a water management facility.

- Sustaining capital costs include expansion of the TSF, refurbishment and replacement of processing equipment, and mine closure of $39 M.

Pit Design, SW-NE Section View

Notes: Net Smelter Prices (“NSP”) and metallurgical recoveries are used to define the NSR cutoff grade. NSPs include market price assumptions of $23.0/oz Ag, $0.95/lb Pb, $1.25/lb Zn. Various smelter and refining terms, offsite costs, and a 6% royalty derive NSPs of $20.5/oz Ag, $0.64/lb Pb, and $0.74/lb Zn. Metallurgical recoveries of 90% Ag, 83% Pb, and 58% Zn are applied. The metal prices, smelter terms, and recoveries for the economic analysis are slightly different from the values described here. Checks have been made by the qualified person to ensure that the PEA mine plan would not be materially altered by revising these inputs to the final PEA values.

Qualified Persons

The qualified persons for the PEA are Mr. Marcelo del Giudice, FAusIMM, Principal Metallurgist with RPMGlobal, Mr. Pedro Repetto, SME, P.E., Principal Civil/Geotechnical Engineer with RPMGlobal, Mr. Gonzalo Rios, FAusIMM, Executive Consultant – ESG with RPMGlobal, Mr. Jinxing Ji, P.Eng., Metallurgist with JJ Metallurgical Services, and Mr. Marc Schulte, P.Eng., Mining Engineer with Moose Mountain Technical Services. The specific sections for which each qualified person is responsible will be outlined in the NI 43-101 PEA Technical Report. This is in addition to Mr. Anderson Candido, FAusIMM, Principal Geologist with RPMGlobal who estimated the Mineral Resource. All such qualified persons have reviewed the technical content relevant to the sections of the PEA for which they are responsible included in the October 1, 2024 news release for the deposit at the Project and have approved its dissemination.

Further details supporting the PEA will be available in an NI 43‐101 Technical Report which will be posted under the Company’s profile at sedarplus.com within 45 days of the October 1, 2024 news release.

The October 1, 2024 news release has been reviewed and approved by Alex Zhang, P.Geo., Vice President of Exploration of New Pacific Metals Corp. who is the designated qualified person for the Company.

CAUTIONARY NOTE REGARDING RESULTS OF PRELIMINARY ECONOMIC ASSESSMENT

The results of the PEA prepared in accordance with NI 43-101 titled “Carangas Deposit – Preliminary Economic Assessment” with an anticipated effective date of October 1, 2024 and prepared by certain qualified persons associated with RPMGlobal are preliminary in nature and are intended to provide an initial assessment of the Project’s economic potential and development options of the Project. The PEA mine schedule and economic assessment includes numerous assumptions and is based on both indicated and Inferred Mineral Resources. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessments described herein will be achieved or that the PEA results will be realized. The estimate of Mineral Resources may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. Mineral resources are not Mineral Reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the Inferred Mineral Resources to be considered in future advanced studies. RPMGlobal (mineral resource, infrastructure, tailings, water management, environmental and financial analysis) was contracted to conduct the PEA in cooperation with Moose Mountain Technical Services (mining), and JJ Metallurgical Services (Metallurgy). The qualified persons for the PEA for the purposes of NI 43-101 are Mr. Marcelo del Giudice, FAusIMM, Principal Metallurgist with RPMGlobal, Mr. Pedro Repetto, SME, P.E., Principal Civil/Geotechnical Engineer with RPMGlobal, Mr. Gonzalo Rios, FAusIMM, Executive Consultant – ESG with RPMGlobal, Mr. Jinxing Ji, P.Eng., Metallurgist with JJ Metallurgical Services, and Mr. Marc Schulte, P.Eng., Mining Engineer with Moose Mountain Technical Services., in addition to Mr. Anderson Candido, FAusIMM, Principal Geologist with RPMGlobal who estimated the Mineral Resources. All qualified persons for the PEA have reviewed the disclosure of the PEA herein. The PEA is based on the MRE, which was reported on September 5, 2023. The effective date of the MRE is August 25, 2023. Mineral Resources are constrained by an optimized pit shell at a metal price of US$23.00/oz Ag, US$1,900.00/oz Au, US$0.95/lb Pb, US$1.25/lb Zn, recovery of 90% Ag, 98% Au, 83% Pb, 58% Zn and Cut-off grade of 40 g/t AgEq. Assumptions made to derive a cut-off grade included mining costs, processing costs, and recoveries were obtained from comparable industry situations.

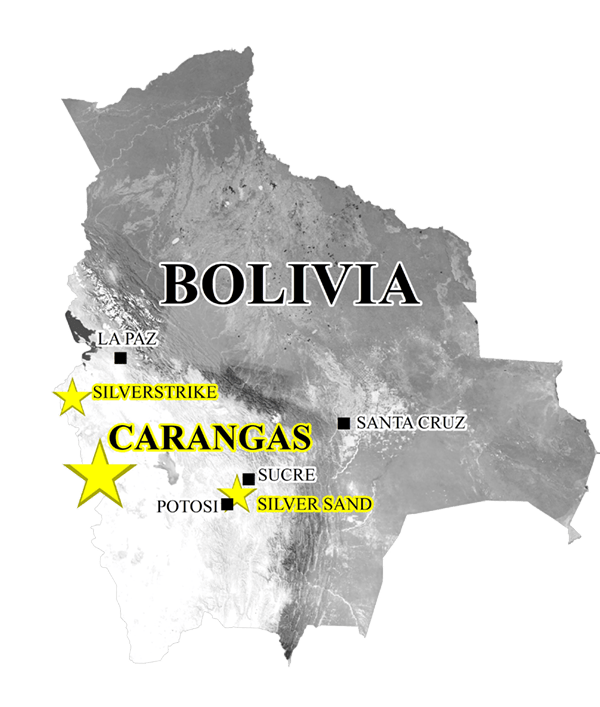

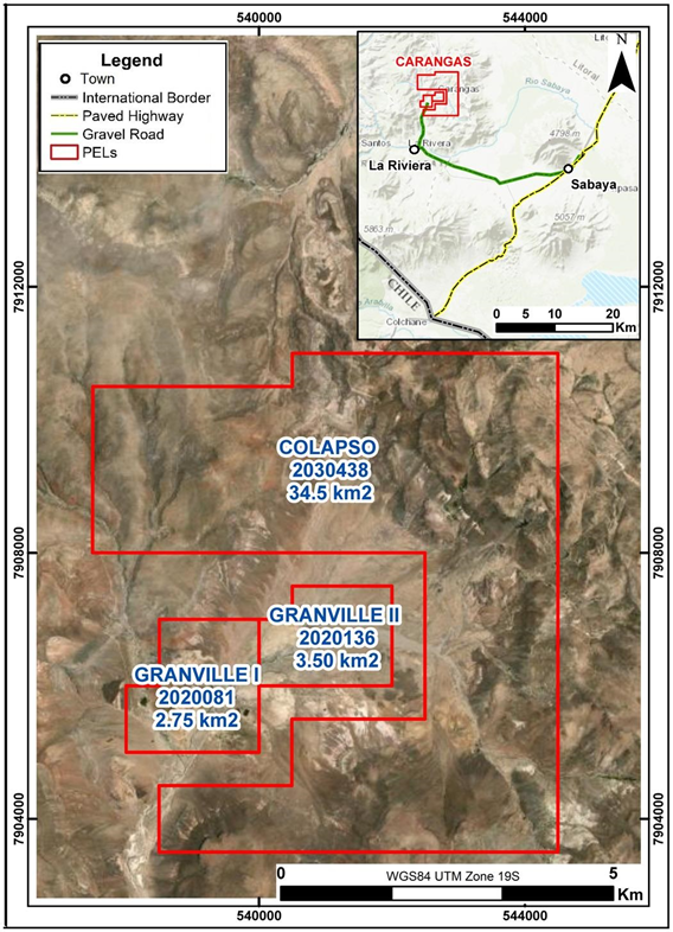

A Globally Significant Silver-Gold Polymetallic Discovery

The Carangas Project is located about 190 km southwest of Oruro, Bolivia, within the South American Epithermal Belt, which hosts large precious metal deposits and operations in neighbouring countries but remains under-explored in Bolivia. The property comprises three Exploration Licenses (Granville I, Granville II and Colapso) spanning a total area of 40.75 square kilometers, and is road accessible.

In April 2021, the Company announced that it had entered into a Mining Associate Contract with a private Bolivian corporation. Under the Contract, the Company will cover 100% of future expenditures for exploration, mining, development, and production activities and will receive 98% of operational profits once Carangas moves to the mining production stage. The agreement has a term of 30 years and is renewable for another 15 years.

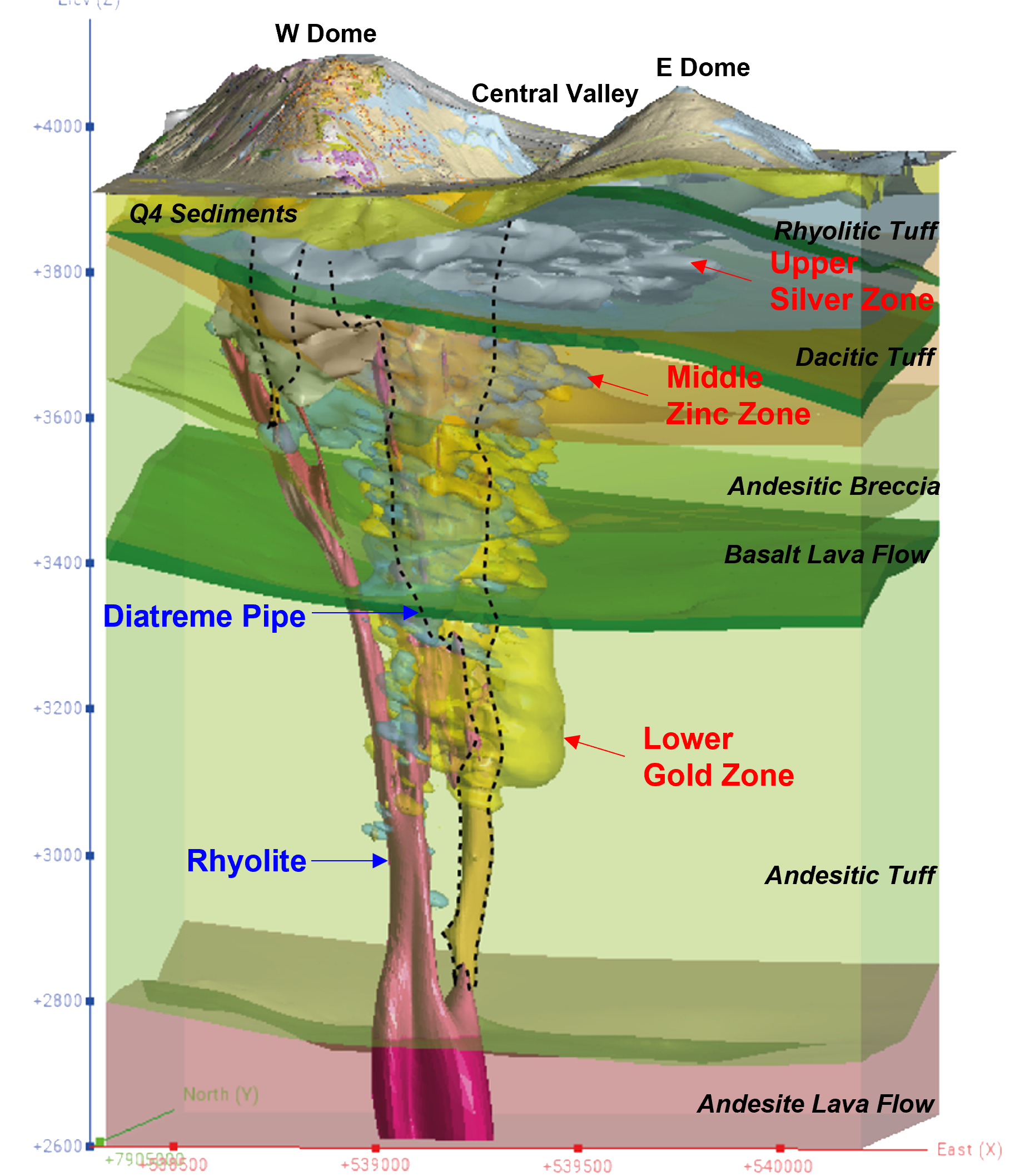

The Carangas Project is hosted within a volcanic caldera system. This system is centered around a Tertiary-aged diatreme. The mineralization process was influenced by the heat gradient from rhyolitic intrusions within the diatreme. This process resulted in the formation of three distinct zones: an upper zone rich in silver, a middle zone dominated by zinc and lead, and a lower zone with a higher concentration of gold. Exploration commenced mid-2021, and over 81,000 m of drilling in 189 drill holes have been completed.

Historical Exploration and Mining

Mining in the district is thought to have commenced in the sixteenth century and continued intermittently until the early twentieth century. The Project, particularly West Dome, contains extensive surface workings, underground mine adits, shafts and associated processing and smelting infrastructure. There is no active mining at present.

Modern mineral exploration, led by local mining interests, began in the early 1980s. The first drill program, comprising nine reverse circulation holes for a total of 1,000 m, was carried out in 1995. Written records for the program report a drill intercept of 116 m at an average grade of 95 g/t silver (from 18 m to 134 m downhole), including 16 m at 325 g/t silver (from 66 m to 82 m downhole), including a 4-m mined-out interval in hole RC-05.

A second drill program was conducted in 2000, also led by a local Bolivian group, with six diamond drill holes for a total of 914 m completed. The results are in line with prior exploration and include a drill intercept of 76 m at an average grade of 90 g/t silver, 0.96% lead, and 0.12% zinc (from 0 m to 76 m downhole), including 8 m at 266 g/t silver, 1.02% lead, and 0.06% zinc (from 26m to 34 m downhole) in hole DDH-01. No recorded exploration activities occurred over the next 20 years until the Company’s involvement.

Geological Overview

The Carangas Project is hosted within a volcanic caldera system. This system is centered around a Tertiary-aged diatreme. The mineralization process was influenced by the heat gradient from rhyolitic intrusions within the diatreme. This process resulted in the formation of three distinct zones: an upper zone rich in silver, a middle zone dominated by zinc and lead, and a lower zone with a higher concentration of gold.

Exploration Highlights

Below the 2023 Mineral Resource Estimate conceptual pit constraint exists gold-dominated mineralized material of similar size and grade to the reported mineral resources of the Lower Gold Zone. This mineralized material has the potential to be converted to mineral resources amendable to underground mining pending further evaluation for reasonable prospects of eventual economic extraction. Gold mineralization remains open to the north and northeast at depth.

Regional Exploration Potential

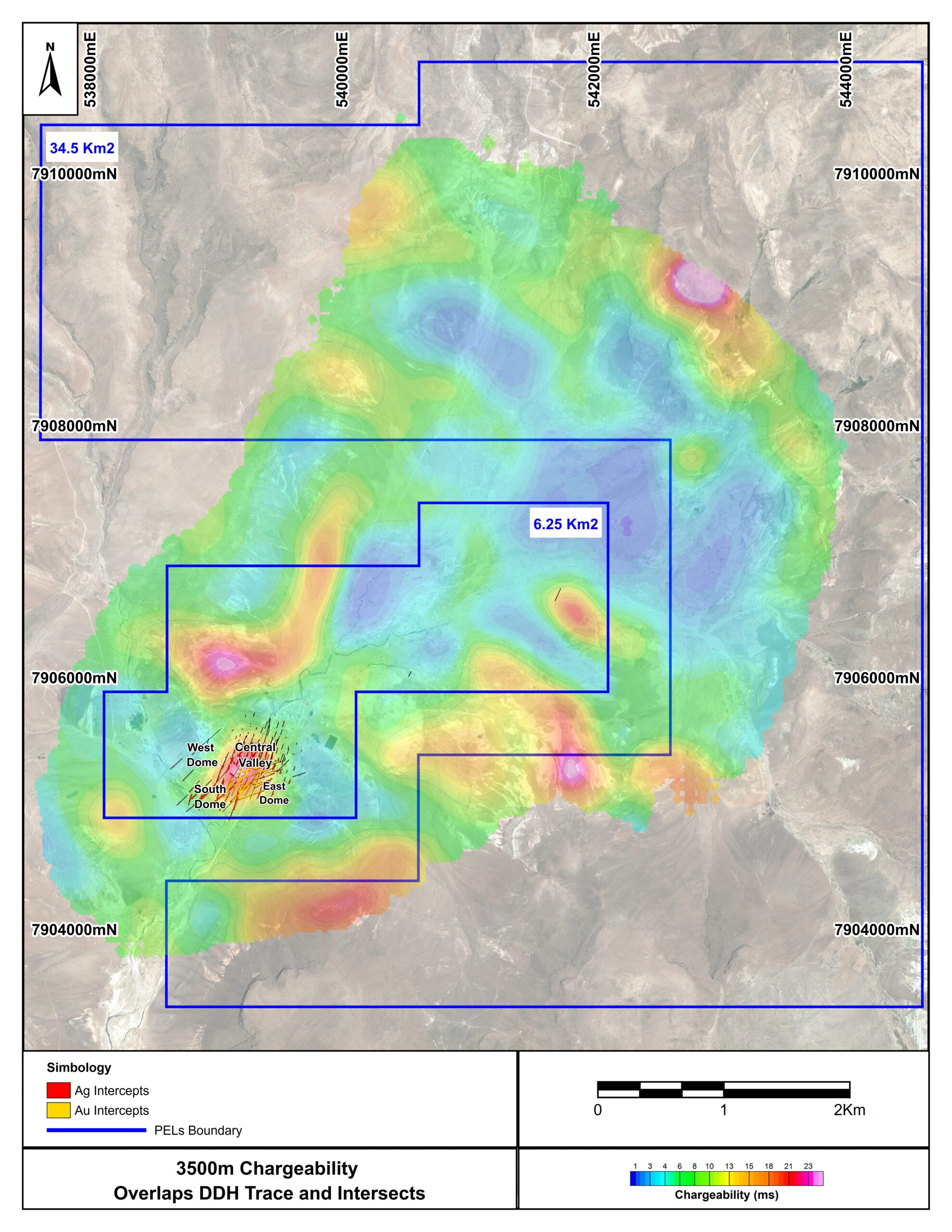

The Company also completed a 3D Bipole-Dipole IP-MT survey in an area of approximately 29 square kilometers over the entire Carangas caldera basin in early 2023. This survey demonstrated that the known gold mineralization system overlays a strong chargeability anomaly in the Central Valley area. In addition, multiple strong IP chargeability anomalies were identified beyond the drilled areas. The Company believes that these anomalies may host mineralization similar to what has been drilled thus far, underscoring the potential for mineral resource growth through additional drilling campaigns.

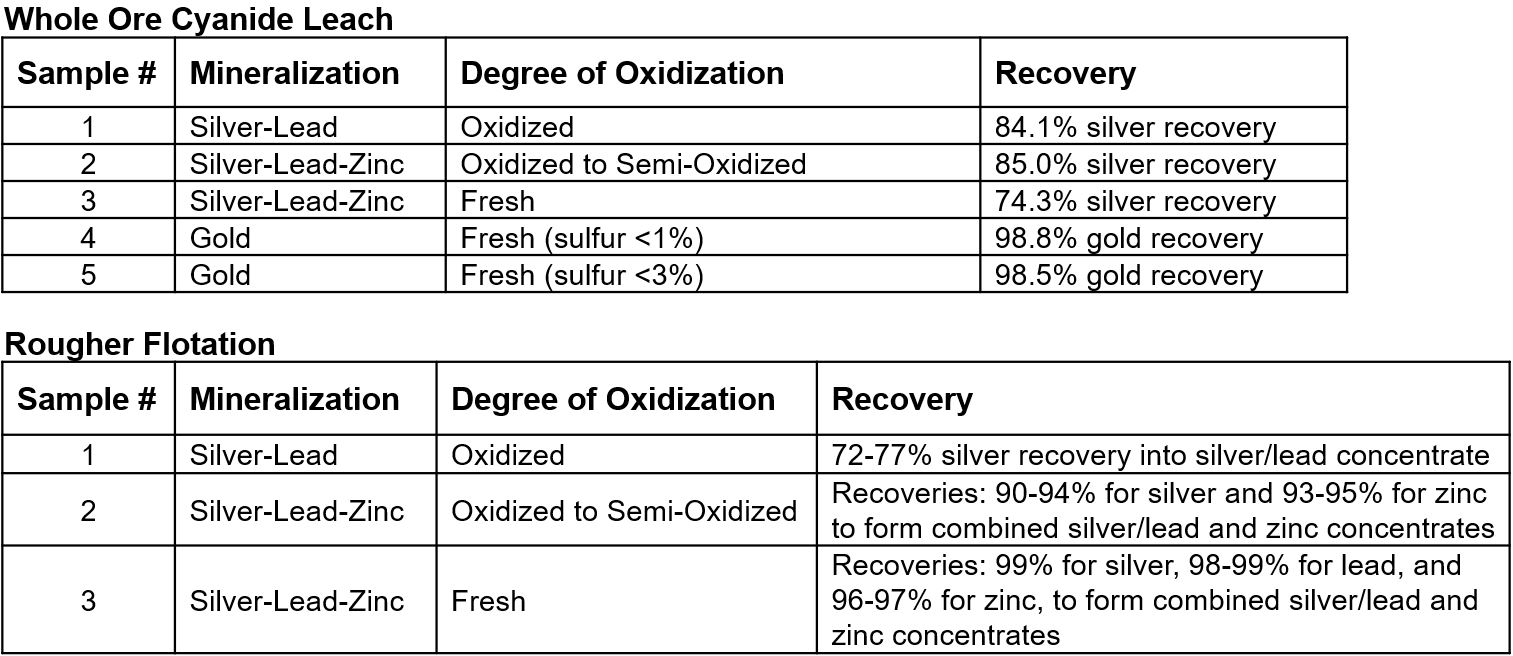

Metallurgical Testing

Preliminary metallurgical testwork consists of scoping-level cyanide leach and flotation testing and is carried out by Bureau Veritas’s Metallurgical Division in Richmond, British Columbia, Canada. Mineralized materials sampled from rejects of selected Carangas drill cores with assays were composited to five samples based on the type of mineralization and degree of oxidization. Host rock sample is altered volcanoclastic rocks of dacitic-rhyolitic composition.

These preliminary test results clearly demonstrate that high recovery rates can be expected for gold using cyanide leaching and for silver, lead, and zinc through conventional cyanide leaching and flotation for silver-lead-zinc mineralized materials. Based on the preliminary metallurgical test results, the following recommendations can be made with respect to the selection of flowsheet for the future process plan:

For gold, cyanide leach and carbon-in-pulp (CIP) may potentially achieve an average of 98.6% gold recovery. Gold doré will be the final product.

For silver-lead-zinc, silver/lead concentrate and zinc concentrate may be produced by sequential selective flotation or gravity concentration. The resultant silver/lead concentrate may be treated by cyanide leach to enable silver doré production.

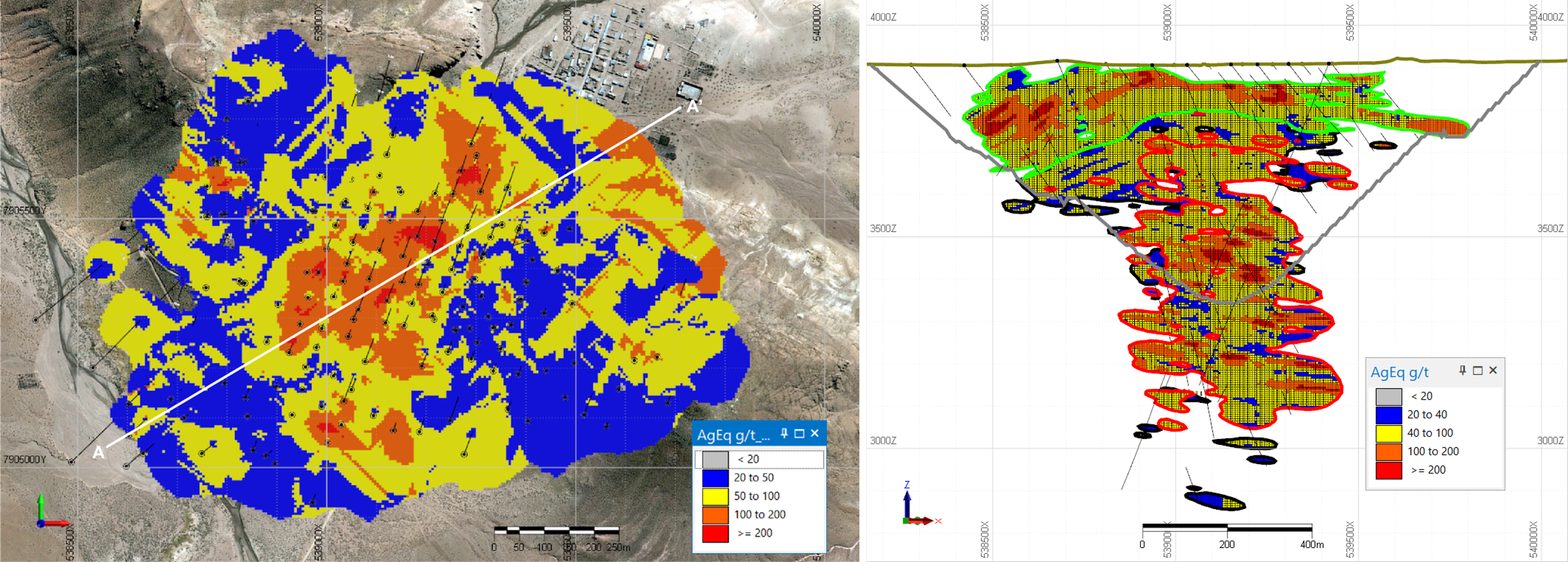

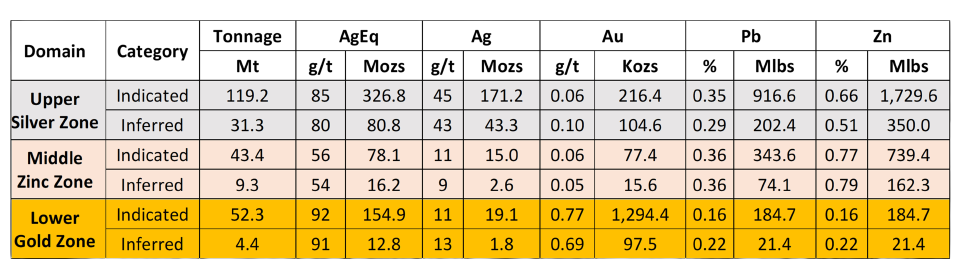

Inaugural Mineral Resource Estimate

On September 5, 2023, the Company report the inaugural independent National Instrument 43‐101 – Standards of Disclosure for Mineral Projects (NI 43-101) mineral resource estimate (MRE) for its 98%-controlled Carangas silver-gold polymetallic deposit in Bolivia (effective August 25, 2023). Notes:

Notes: - CIM Definition Standards (2014) were used for reporting the mineral

- The qualified person (as defined in NI 43-101) for the purposes of the MRE is Anderson Candido, FAusIMM, Principal Geologist with RPM (the “QP”).

- Mineral resources are constrained by an optimized pit shell at a metal price of US$23.00/ounce (“oz”) Ag, US$1,900/oz Au, US$0.95/pound (“lb”) Pb, US$1.25/lb Zn, US$4.00/lb Cu, recovery of 90% Ag, 98% Au, 83% Pb, 58% Zn and Cut-off grade of 40 g/t

- Mineral resources are reported inside the property

- Average stripping ratio for the conceptual pit is ~1.8:1. The conceptual pit has a dimeter of approximately 1.4 kilometers and extends to a maximum depth of approximately 600 meters from the Central Valley.

- Drilling results up to June 1,

- The numbers may not compute exactly due to

- Mineral resources are reported on a dry in-situ basis.

- Mineral resources are not Mineral Reserves and do not have demonstrated economic viability.

- Total indicated mineral resources of 214.9 million tonnes (“Mt”) containing 205.3 million ounces (“Mozs”) of silver (“Ag”), 1,588.2 thousand ounces (“Kozs”) of gold (“Au”), 1,444.9 million pounds (“Mlbs”) of lead (“Pb”), 2,653.7 Mlbs of zinc (“Zn”), and 112.6 Mlbs of copper (“Cu”); or collectively 559.8 Mozs silver equivalent (“AgEq”).

- Total inferred mineral resources of 45.0 Mt containing 47.7 Mozs of silver, 217.7 Kozs of gold, 297.9 Mlbs of lead, 533.7 Mlbs of zinc, and 16.8 Mlbs of copper; or collectively 109.8 Mozs AgEq.

- Carangas is a globally significant Ag-Au polymetallic discovery.

- Mineralization starts at or near surface, potentially allowing for open-pit mining with an average stripping ratio for the conceptual pit of approximately 1.8:1 (tonnes of waste : tonnes of mineral resource).

- Below the pit constraint, substantial gold-dominant mineralization, similar in size and grade to the reported gold domain, has the potential for conversion to underground mineable resources pending further evaluation for reasonable prospects of eventual economic extraction.

- Favorable initial metallurgical test work indicates laboratory‐based recoveries of up to 90% for silver and 98% for gold based on a combination of flotation and cyanide leaching.