VANCOUVER, British Columbia, Feb. 13, 2020 (GLOBE NEWSWIRE) — New Pacific Metals Corp. (“New Pacific” or the “Company”) (TSX-V: NUAG) (OTCQX: NUPMF) today announced its unaudited condensed consolidated interim financial results for the three and six months ended December 31, 2019.

This news release should be read in conjunction with the Company’s management discussion & analysis and the financial statements and notes thereto for the corresponding period, which have been posted under the Company’s profile on SEDAR at www.sedar.com and are also available on the Company’s website at www.newpacificmetals.com. All figures are expressed in Canadian dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

Net loss attributable to equity holders of the Company for the three months ended December 31, 2019 was $1,599,824 or $0.01 per share (three months ended December 31, 2018 – net income of $473,838 or $0.00 per share). The Company’s financial results were mainly impacted by the following: (i) income from investments of $339,654 compared to income of $65,926 in the prior year quarter; (ii) operating expenses of $1,625,133 compared to $658,722 in the prior year quarter; and (iii) foreign exchange loss of $322,879 compared to gain of $1,065,279 in the prior year quarter.

For the six months ended December 31, 2019, net loss attributable to equity holders of the Company was $313,886 or $0.00 per share compared to net loss of $278,745 or $0.00 per share for the six months ended December 31, 2018.

Income from investments for the three months ended December 31, 2019 was $339,654 (three months ended December 31, 2018 – income of $65,926). Within the income from investments, $142,178 was gain on the Company’s equity investments and $189,594 was gain from fair value change and interest earned on bonds.

For the six months ended December 31, 2019, income from investments was $2,455,102 compared to gain of $183,123 for the six months ended December 31, 2018.

Operating expenses for the three and six months ended December 31, 2019 were $1,625,133 and $2,634,073, respectively (three and six months ended December 31, 2018 – $658,722 and $1,189,995, respectively).

Foreign exchange loss for the three months ended December 31, 2019 was $322,879 (three months ended December 31, 2018 – gain of $1,065,279). The Company holds a large portion of cash and cash equivalents and bonds in US dollars while the Company’s functional currency is Canadian dollar. The fluctuation in exchange rates between the US dollar and the Canadian dollar will impact the financial results of the Company. During the three months ended December 31, 2019, the US dollar depreciated by 1.9% against the Canadian dollar (from 1.3243 to 1.2988) while in the prior year quarter the US dollar appreciated by 5.4% against the Canadian dollar (from 1.2945 to 1.3642).

For the six months ended December 31, 2109, foreign exchange loss was $146,537 (six months ended December 31, 2018 – foreign exchange gain of $720,437).

BOUGHT DEAL FINANCING

On October 25, 2019, the Company successfully closed a bought deal financing underwritten by BMO Capital Markets to issue a total of 4,312,500 common shares at a price of $4.00 per common share for gross proceeds of $17,250,000. The underwriter’s fee and other issuance costs for the transaction were $1,416,467.

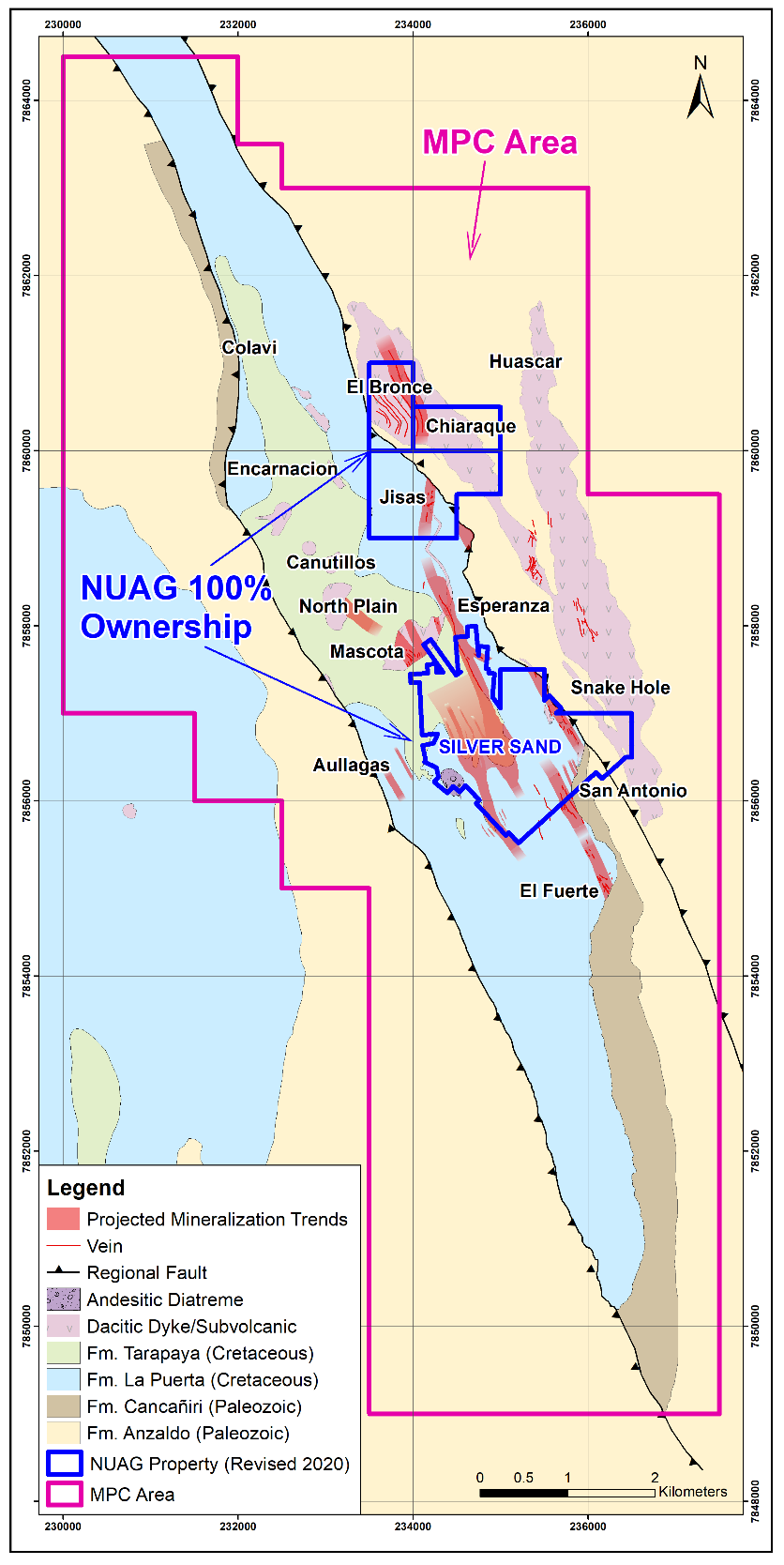

SILVER SAND PROJECT

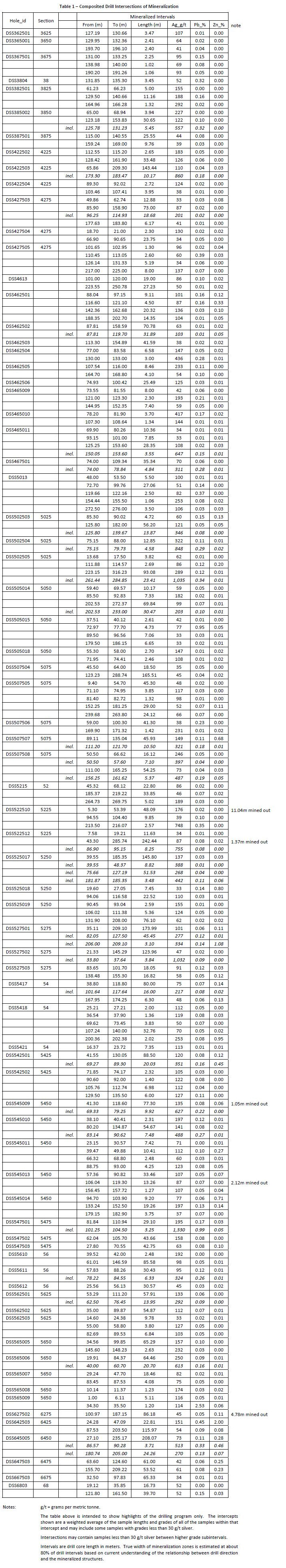

Since acquired by New Pacific in 2017, the Company has carried out extensive risk exploration drilling program on its 100% owned Silver Sand Project. During 2017-2018 discovery exploration drilling campaign, a total of 195 holes in 55,011.8 metres (“m”) of drilling were completed. During the 2019 drilling campaign, a total of 191 drill holes in 42,607.25m of drilling were completed. From 2017 to the end of 2019, the Company has completed 97,619.05m of drilling in 386 drill holes. For details of the drilling programs, please review the Company’s news releases dated January 22, 2019, February 20, 2019, April 25, 2019, June 6, 2019, August 7, 2019, August 20, 2019, August 23, 2019, August 27, 2019, December 2, 2019, and January 13, 2020 available under the Company’s profile on SEDAR at www.sedar.com or on the Company’s website at www.newpacificmetals.com. On November 4, 2019, the Company filed and updated a technical report for the Silver Sand Project pursuant to National Instrument 43-101 – Standards of Disclosure for Mineral Projects. A copy of this technical report is available under the Company’s profile under SEDAR at www.sedar.com.

For the three and six months ended December 31, 2019, total expenditures of $3,697,610 and $8,537,035, respectively (three and six months ended December 31, 2018 – $3,413,976 and $6,593,939, respectively) were capitalized under the project for expenditures related to the 2019 drilling program, site and camp service and construction, and maintaining a regional office in La Paz, a management team, and workforce for the project.

In December 2019, the Company further expanded its Silver Sand land package by acquiring a 100% interest in a Special Temporary Authorization (“ATE”) located immediately to the north of the project by making a one-time cash payment of US$200,000 to arm’s length private owners. This newly acquired ATE currently consists of six hectares but will total approximately 0.50 square kilometres once it has been consolidated to concessions called “Cuadriculas” and converted to Mining Administrative Contract with Bolivia’s Autoridad Jurisdiccional Administrativa Minera (“AJAM”).

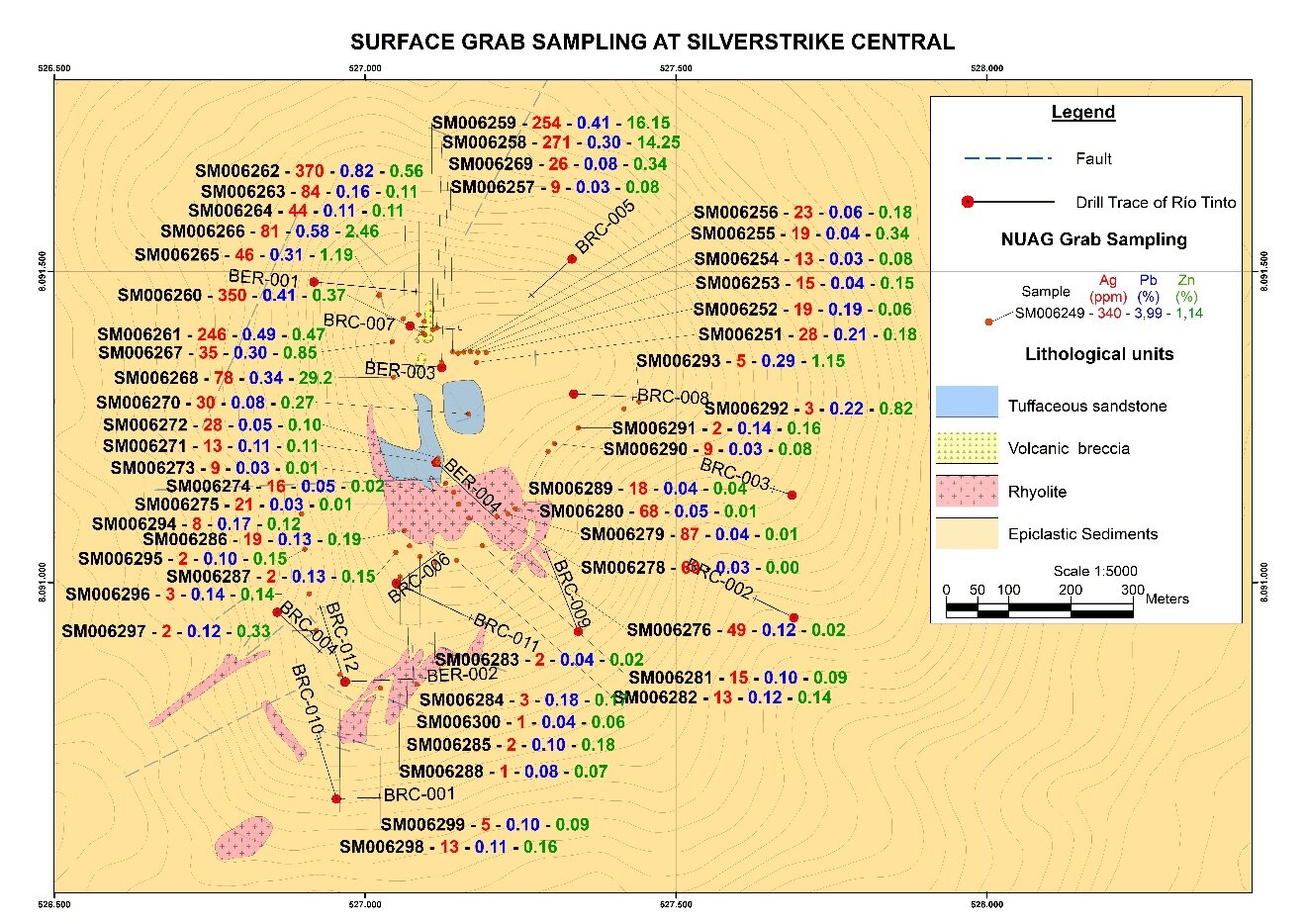

SILVERSTRIKE PROJECT

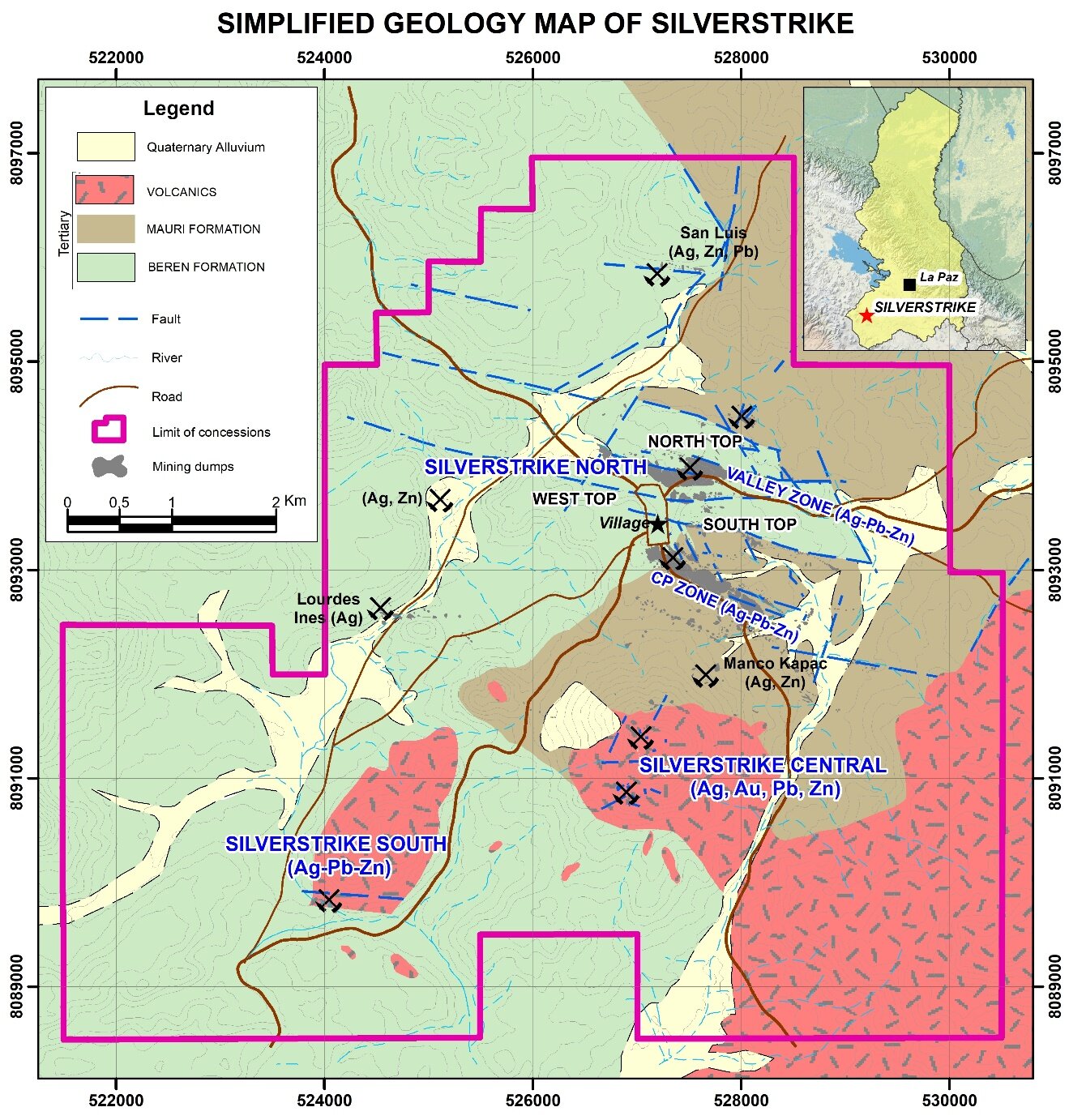

In December 2019, the Company, through its wholly-owned subsidiary, signed an agreement with an arm’s length private Bolivian corporation (the “Vendor”) to acquire a 98% interest in the Silverstrike silver project from the Vendor by making a one-time cash payment of US$1,350,000. The Company will cover 100% of the future expenditures of exploration, mining, development and production activities. The agreement has a term of 30 years and renewable for another 15 years without any payment and is subject to an approval by AJAM in Bolivia.

The Silverstrike Project, at an elevation of 4,000 to 4,500 metres, is located approximately 140 kilometres (“km”) southwest of La Paz, Bolivia or approximately 450 km northwest of the Company’s Silver Sand Project. The Silverstrike Project consists of nine ATEs with an area of approximately 13km² currently in the process of conversion to Mining Administrative Contracts before AJAM. The Vendor has also applied for exploration rights over areas surrounding the Silverstrike Project as part of the transaction.

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company which owns the Silver Sand Project, in the Potosí Department of Bolivia, and the Tagish Lake Gold Project in Yukon, Canada.

For further information, please contact:

New Pacific Metals Corp.

Gordon Neal

President

Phone: (604) 633-1368

Fax: (604) 669-9387

info@newpacificmetals.com

www.newpacificmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATIONCertain of the statements and information in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management and others.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form for the year ended June 30, 2019 under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements or information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements or information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements or information.

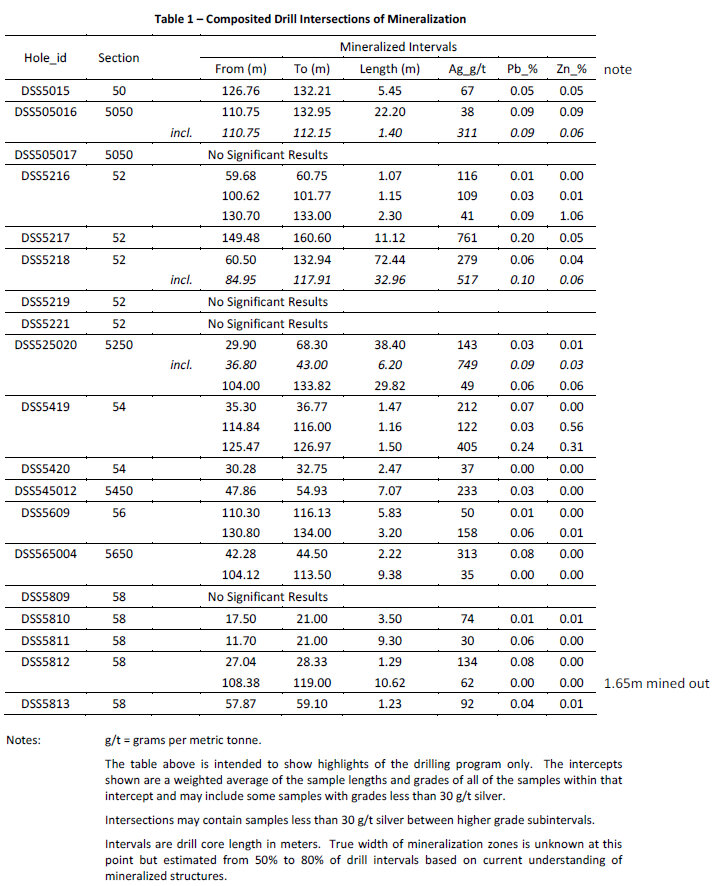

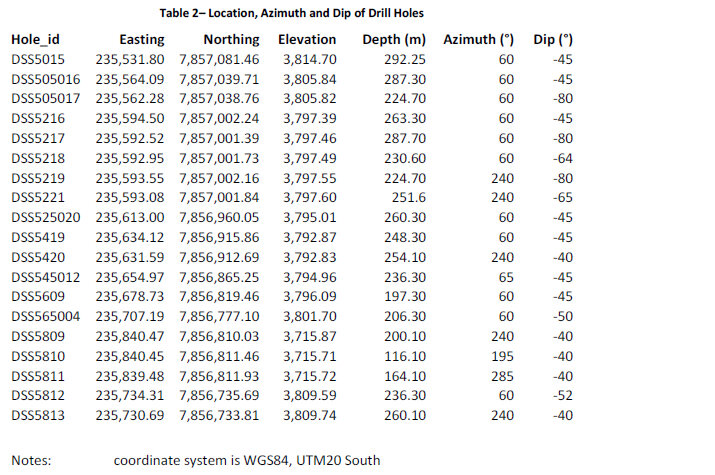

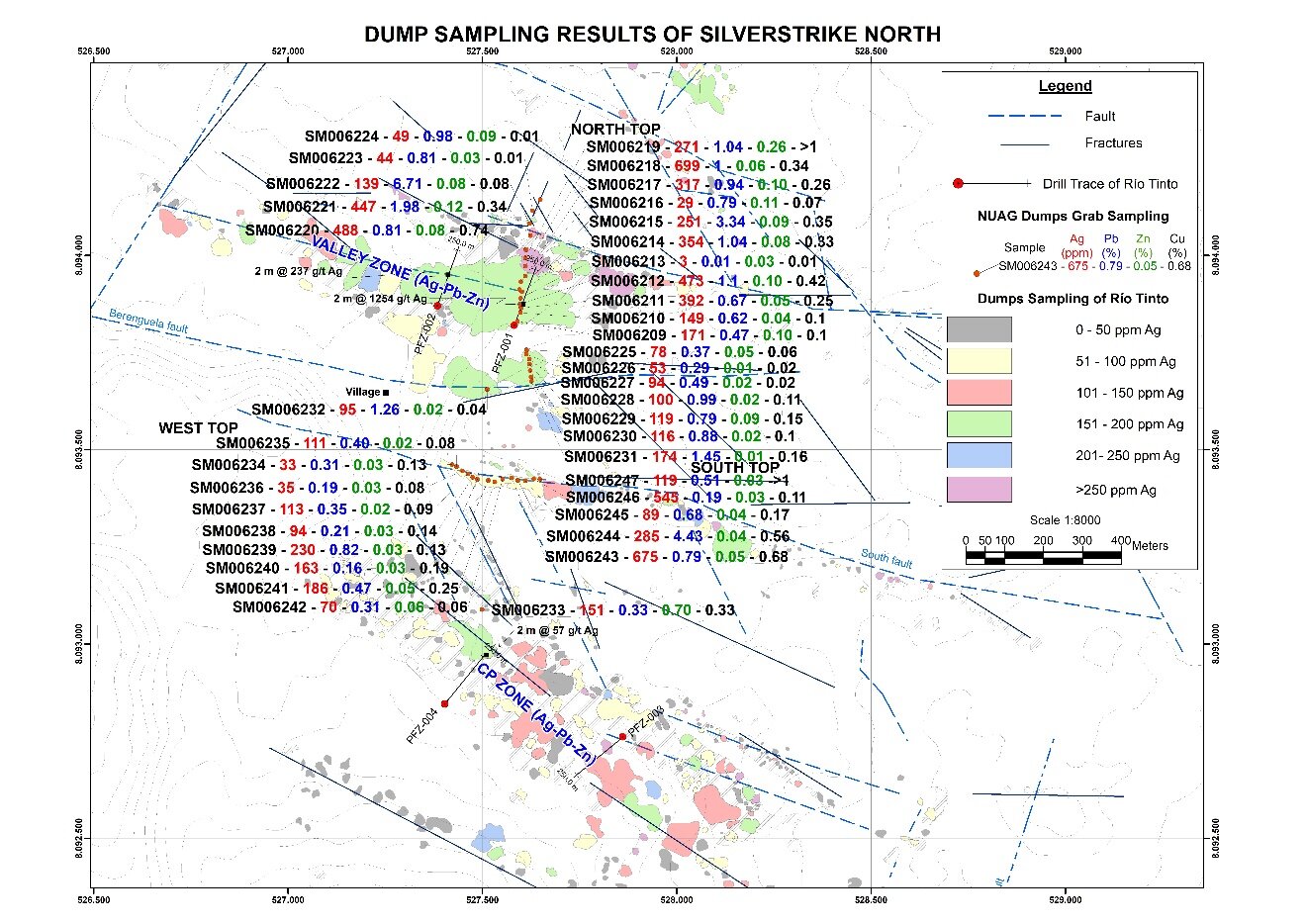

![[1]The grab samples are selected samples and are not necessarily representative of the mineralization hosted on the property.](https://www.newpacificmetals.com/wp-content/uploads/2022/09/table.jpg)