Vancouver, British Columbia – July 13, 2020 – New Pacific Metals Corp. (TSX-V: NUAG) (OTCQX: NUPMF) (“New Pacific” or the “Company”) is pleased to announce the assay results from the four in-fill drilling holes at the Silver Sand Project. Holes were drilled to obtain representative samples for detailed metallurgical work required by a Preliminary Economic Assessment (PEA) study.

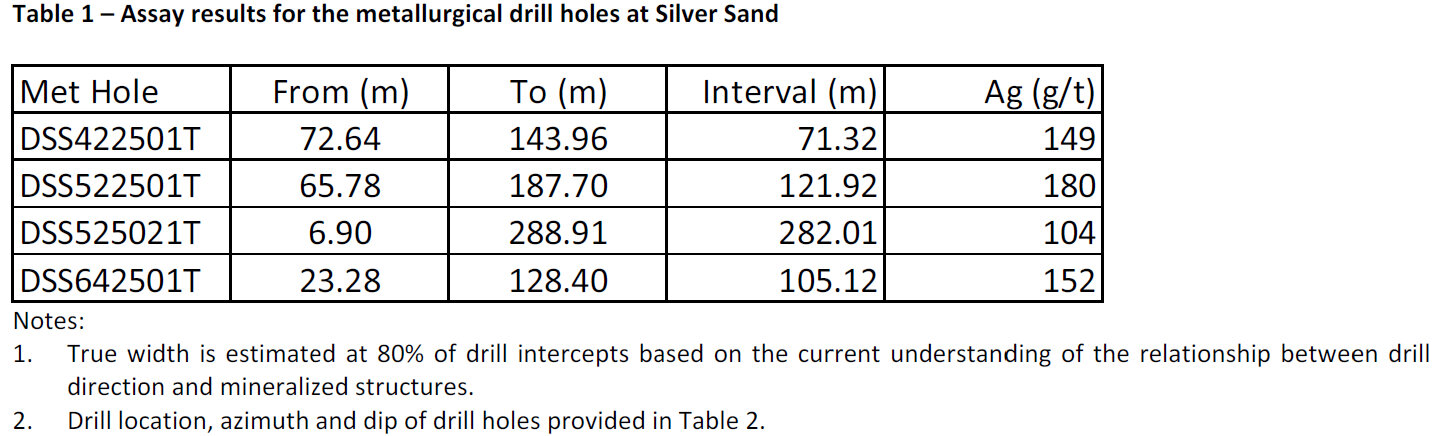

Assay results from these metallurgical holes, as summarized in Table 1 below, compare favourably to those previously released near-by holes in intervals and silver grades and further demonstrate continuity of silver mineralization. Highlight of the results includes 282.01 m intersection grading 104 g/t silver in hole DSS525021T.

In addition, the Company has also developed a composting and sampling program to collect approximately 1,500 kg of drill core and coarse reject samples from previous drilling campaigns for metallurgical testing.

Quality Assurance and Quality Control

HQ-size drill core samples are split into equal halves by diamond saw, with an average sample length of between one to one and a half metres at the Company’s core processing facility in Betanzos, a small town located 20 kilometres from the project site. Half core samples are stored in a secure storage facility in Betanzos for future reference, with the other half shipped in securely sealed bags to ALS Global in Oruro, Bolivia for preparation, and ALS Global in Lima, Peru for geochemical analysis. All samples are first analyzed by a multi-element ICP package (ALS code ME-MS41) with ore grade over limits for silver, lead and zinc further analyzed using ALS code OG46. Further silver over limits are analyzed by gravimetric analysis (ALS code of GRA21).

A standard quality assurance and quality control (“QAQC”) protocol is employed to monitor the quality of sample preparation and analysis. Standards of certified reference materials and blanks are inserted into the normal core sample sequences prior to shipping to the lab at a ratio of 20:1 (i.e., every 20 samples contain at least one standard sample and one blank sample). In general, duplicate samples of coarse rejects at a ratio of 20:1 are sent to a second internationally accredited lab for check analysis. The assay results of QAQC samples of standards and blanks do not show any significant bias of analysis or contamination during sample preparation.

Technical information contained in this news release has been reviewed and approved by Alex Zhang, P. Geo., Vice President of Exploration, who is a Qualified Person for the purposes of NI 43-101.

About New Pacific

New Pacific is a Canadian exploration and development company which owns the Silver Sand Project in Potosí Department, Bolivia and the Tagish Lake gold project in Yukon, Canada.

For further information, contact:

New Pacific Metals Corp.

Gordon Neal

President

Phone: (604) 633-1368

Fax: (604) 669-9387

info@newpacificmetals.com

www.newpacificmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this news release constitute “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management and others.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form for the year ended June 30, 2019 under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements or information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements or information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements or information.

CAUTIONARY NOTE TO US INVESTORS

This news release has been prepared in accordance with the requirements of NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. Securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects