VANCOUVER, BRITISH COLUMBIA – FEBRUARY 13, 2024: New Pacific Metals Corp. (“New Pacific” or the “Company”) reports its financial results for the three and six months ended December 31, 2023. All figures are expressed in US dollars unless otherwise stated.

Financial Results

Net loss attributable to equity holders of the Company for the three and six months ended December 31, 2023 was $1.52 million and $3.27 million or $0.01 and $0.02 per share, respectively (three and six months ended December 31, 2022 – net loss of $1.87 million and $3.96 million or $0.01 per share and $0.03 per share, respectively). The Company’s financial results were mainly impacted by the following items:

- Operating expenses for the three and six months ended December 31, 2023 of $82 million and $3.69 million, respectively (three and six months ended December 31, 2022 – $1.93 million and $3.99 million, respectively).

- Net Income from investments for the three and six months ended December 31, 2023 of $0.28 million and $0.30 million, respectively (three and six months ended December 31, 2022 – $0.08 million and $0.04 million, respectively).

- Gain on disposal of plant and equipment for the three and six months ended December 31, 2023 of $nil and $0.05 million, respectively (three and six months ended December 31, 2022 – $nil and $nil, respectively).

- Foreign exchange gain for the three and six months ended December 31, 2023 of $0.02 million and $0.07 million, respectively (three and six months ended December 31, 2022 – loss of $0.03 million and $0.01 million, respectively).

Working Capital: As of December 31, 2023, the Company had working capital of $25.70 million.

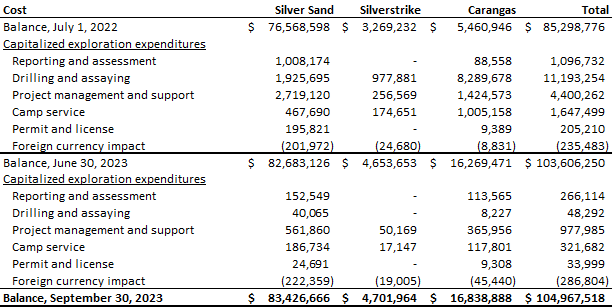

Project Expenditure

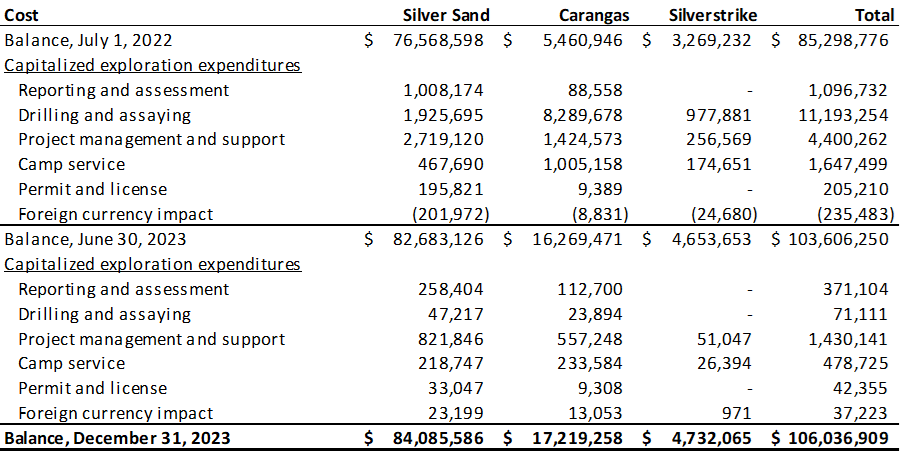

The following schedule summarized the expenditure incurred by category for each of the Company’s projects for relevant periods:

Silver Sand Project

For the three and six months ended December 31, 2023, total expenditures of $0.41 million and $1.38 million, respectively (three and six months ended December 31, 2022 – $1.70 million and $4.20 million, respectively) were capitalized under the project.

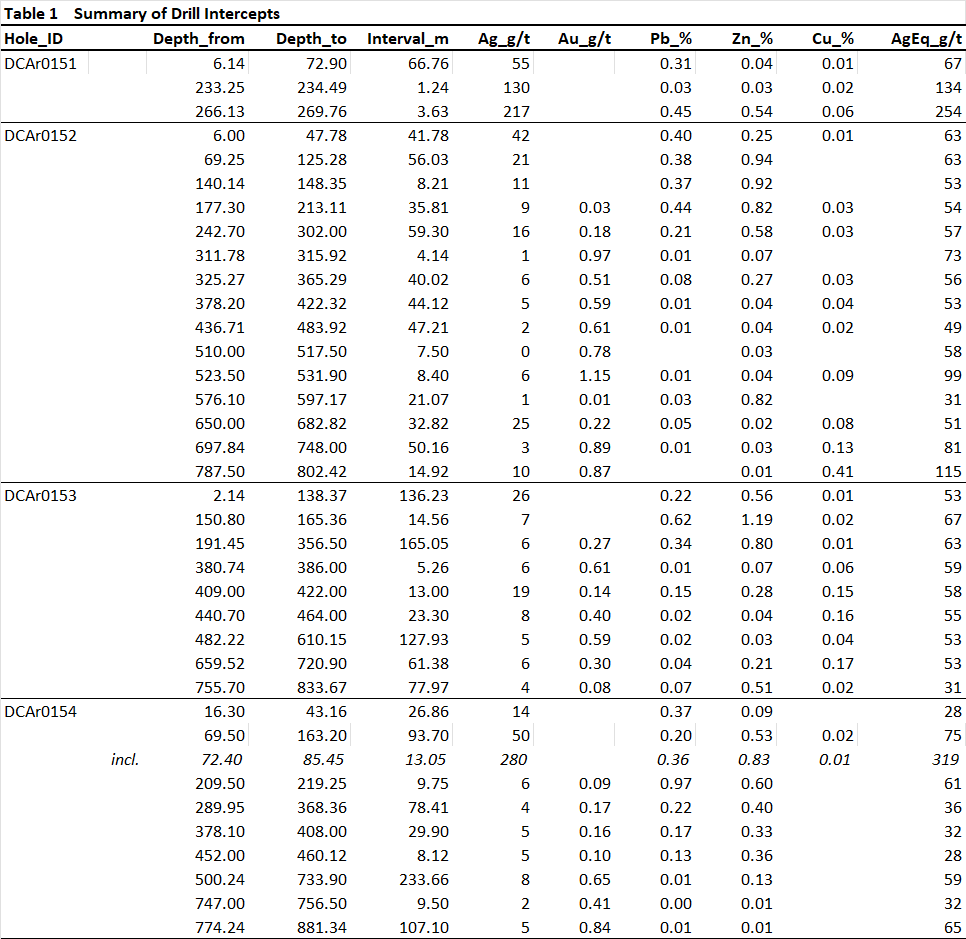

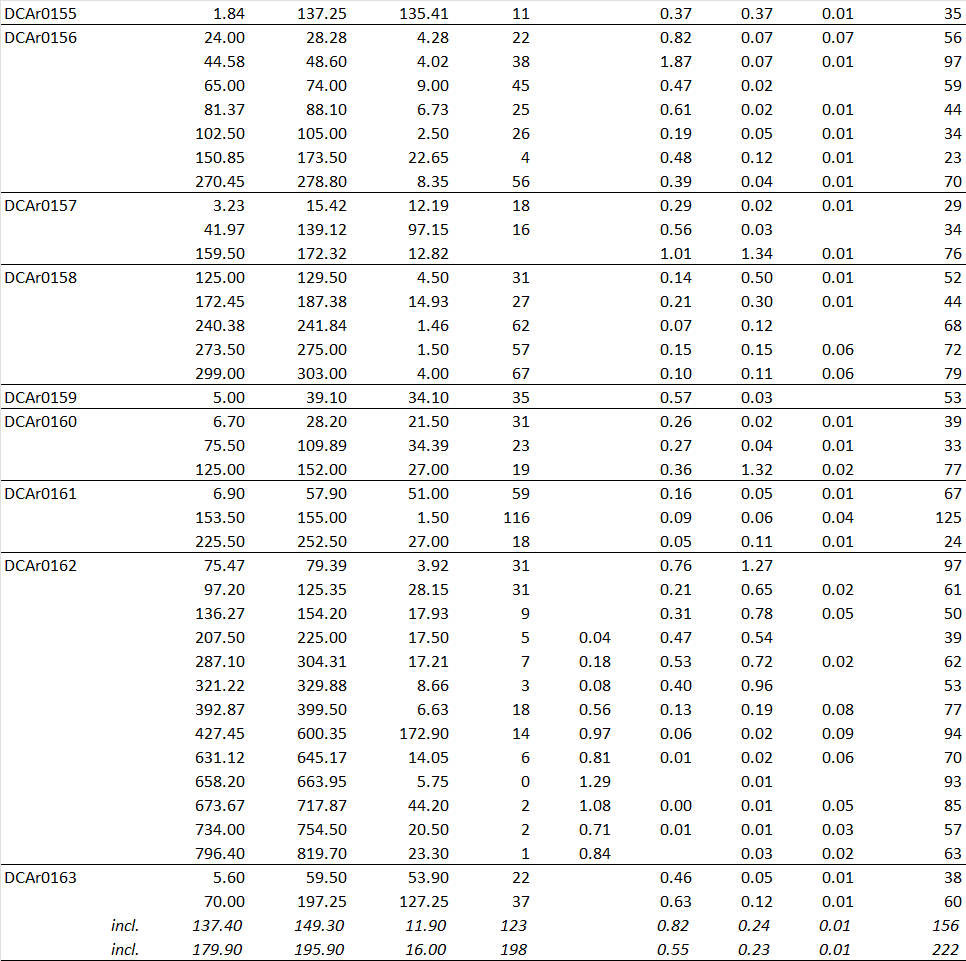

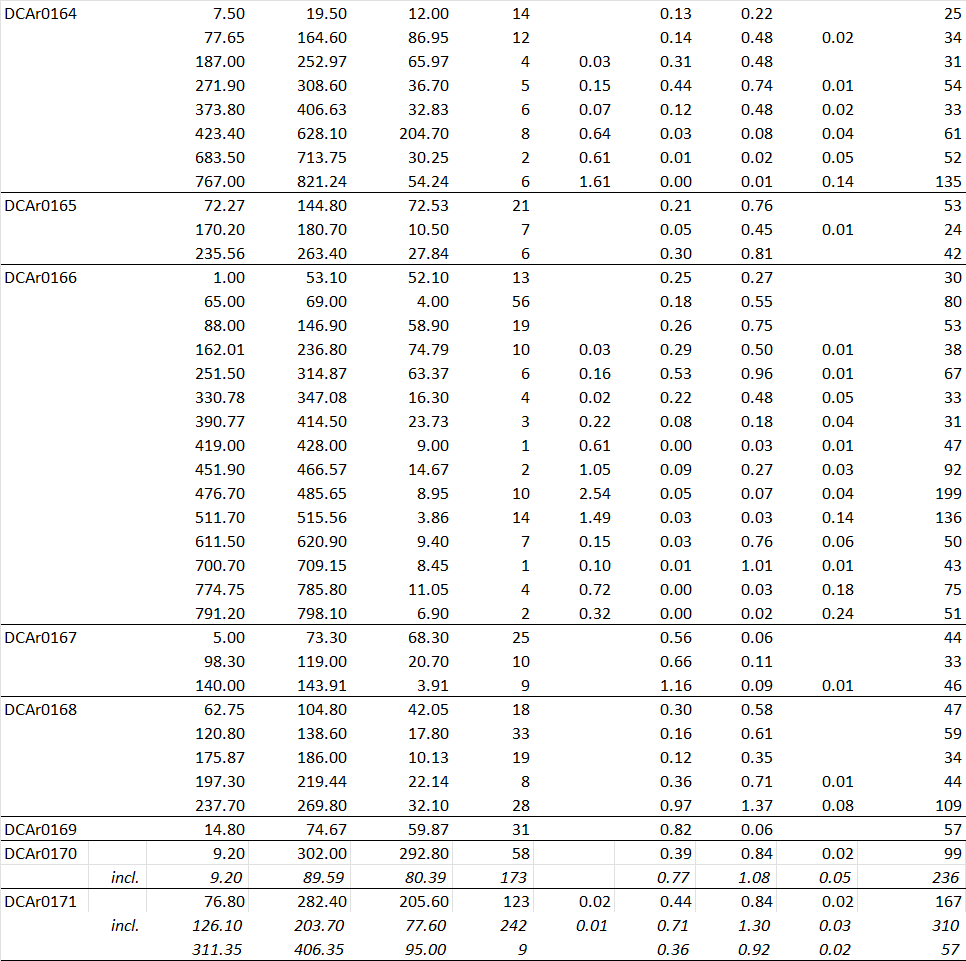

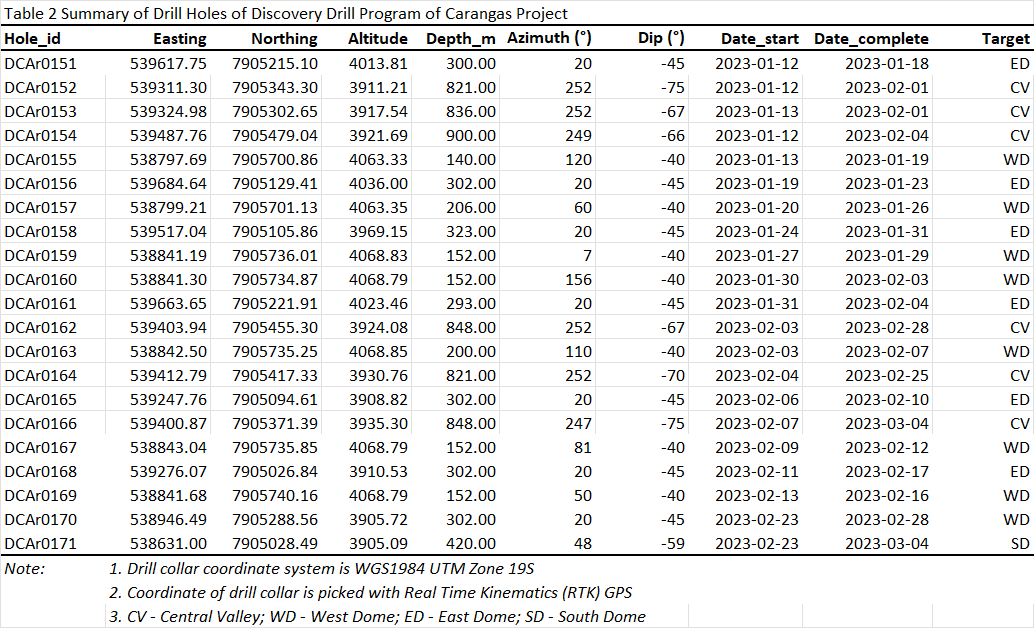

Carangas Project

For the three and six months ended December 31, 2023, total expenditures of $0.32 million and $0.94 million, respectively (three and six months ended December 31, 2022 – $2.87 million and $5.85 million, respectively) were capitalized under the project.

Silverstrike Project

For the three and six months ended December 31, 2023, total expenditures of $0.01 million and $0.08 million, respectively (three and six months ended December 31, 2022 – $0.70 million and $1.15 million, respectively) were capitalized under the project.

Management Discussion and Analysis

This news release should be read in conjunction with the Company’s management discussion and analysis and the unaudited condensed and consolidated financial statements and notes thereto for the corresponding period, which have been filed with the Canadian Securities Administrators and are available under the Company’s profile on SEDAR+ at www.sedarplus.ca,on EDGAR at www.sec.gov and on the Company’s website at www.newpacificmetals.com.

ABOUT NEW PACIFIC

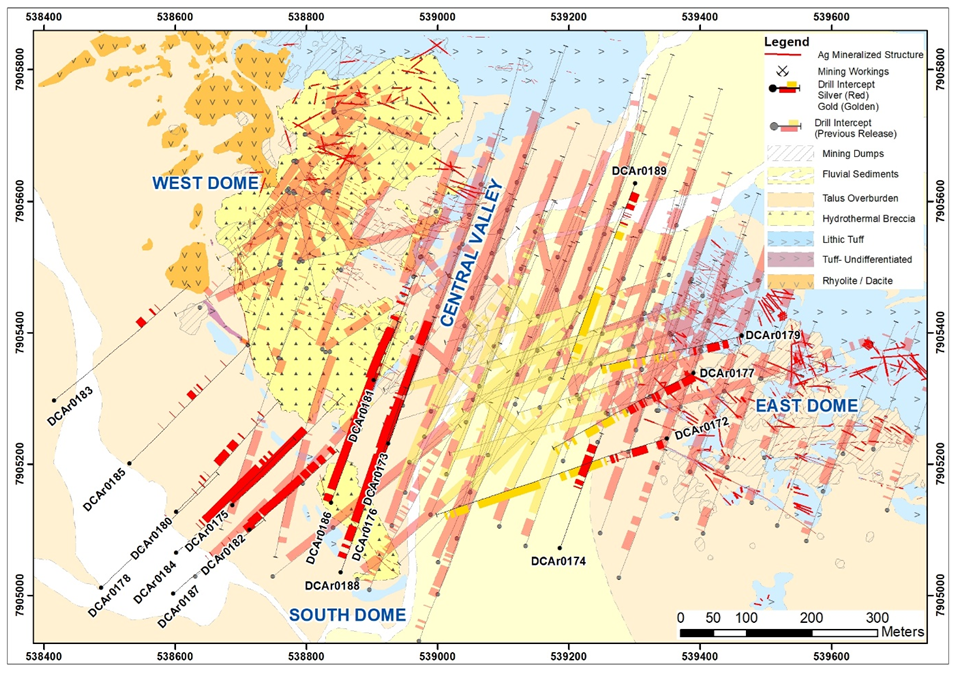

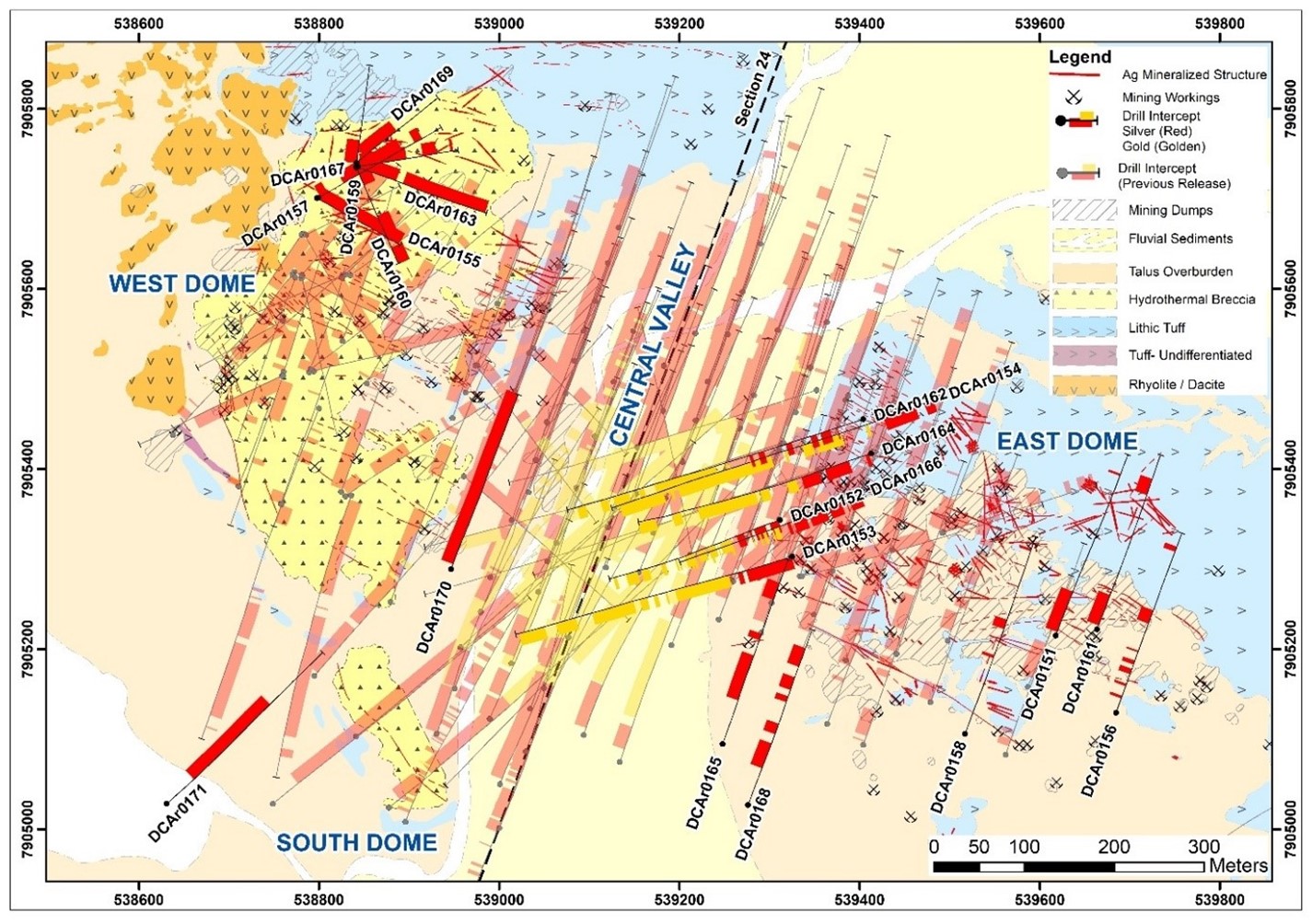

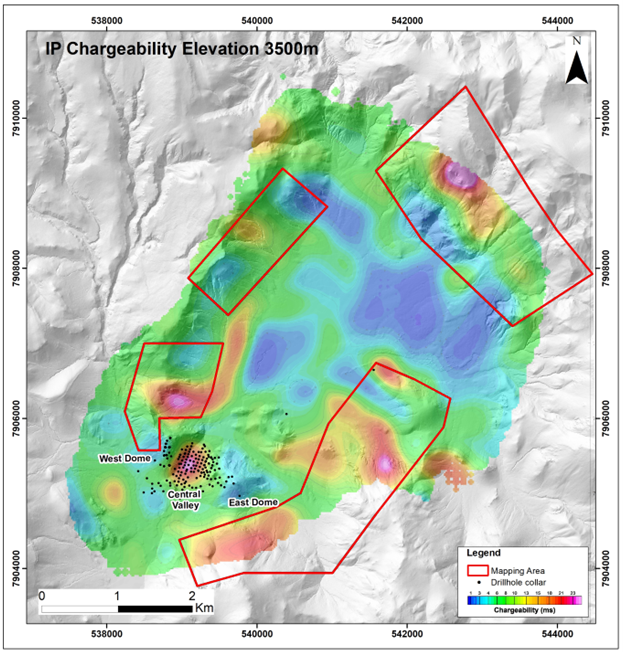

New Pacific is a Canadian exploration and development company with three precious metal projects in Bolivia. The Company’s flagship Silver Sand project has the potential to be developed into one of the world’s largest silver mines. The Company is also rapidly advancing its Carangas project towards a Preliminary Economic Assessment. For the Silverstrike project, the Company completed a discovery drill program in 2022.

For further information, please contact:

Andrew Williams, CEO

New Pacific Metals Corp. Phone: (604) 633-1368 Ext. 236

1750 – 1066 Hastings Street, Vancouver, BC V6E 3X1, Canada

U.S. & Canada toll-free: 1 (877) 631-0593

E-mail: invest@newpacificmetals.com

For additional information and to receive the Company news by e-mail, please register using New Pacific’s website at www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to, statements regarding the Company’s financial results.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada, risks associated with community relations and corporate social responsibility, and other factors described under the heading “Risk Factors” in the Company’s annual information form for the year ended June 30, 2023 and its other public filings. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information.

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company’s ability to carry on current and future operations, including: development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in Bolivia; the Company’s ability to obtain and maintain social license at its mineral properties; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits, including the ratification and approval of the Mining Production Contract with the Corporacion Minera de Bolivia by the Plurinational Legislative Assembly of Bolivia; the ability of the Company’s Bolivian partner to convert the exploration licenses at its Carangas project to administrative mining contracts; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry. Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise defined have the meanings set forth in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Unless otherwise indicated, the technical and scientific disclosure herein has been prepared in accordance with NI 43-101, which differs significantly from the requirements adopted by the United States Securities and Exchange Commission.

Accordingly, information contained in this news release containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

Additional information relating to the Company, including the Company’s annual information form, can be obtained under the Company’s profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov, and on the Company’s website at www.newpacificmetals.com.