Highlights include 176.77 m at 94 g/t AgEq including 60.45 m at 169 g/t AgEq

VANCOUVER, British Columbia – November 22, 2021 – New Pacific Metals Corp. (“New Pacific” or the “Company”) (TSX: NUAG; NYSE American: NEWP), together with its local Bolivian partner, announces the receipt of assay results from five additional drill holes from the Phase I discovery drill program at the Carangas Silver Project, Oruro Department, Bolivia (the “Carangas Project” or the “Project”).

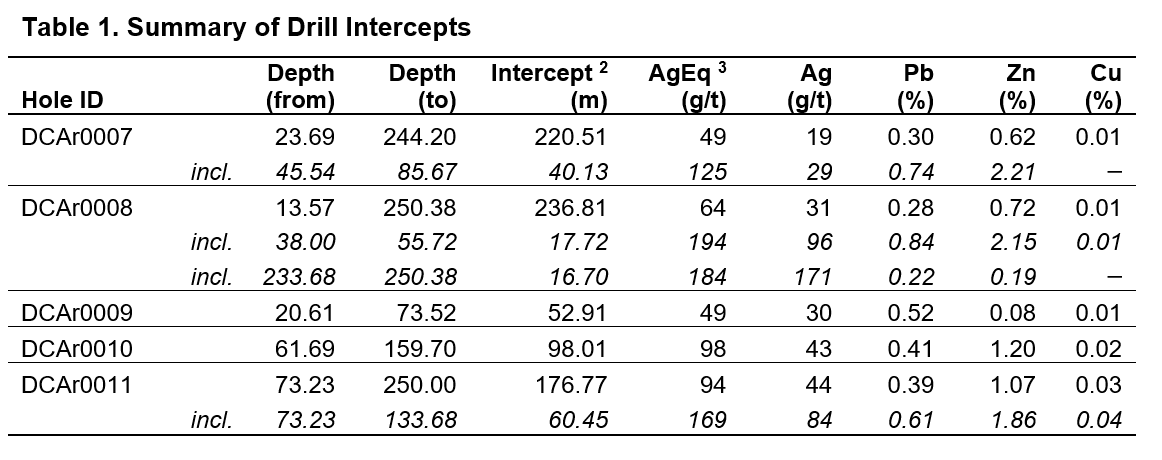

Similar to the first six drill holes reported previously, all five drill holes intersected broad zones of silver-rich, polymetallic mineralization in the Central Valley Zone starting near-surface or immediately beneath younger fluvial sediment cover and continuing to depth (Table 1 and Figure 1).

Dr. Mark Cruise, CEO of New Pacific, notes: “Ongoing drilling continues to increase the size of the silver-rich polymetallic mineralization at the emerging Carangas discovery. We are encouraged by the most recent intercepts in the Central Valley Zone which confirm the presence of a large mineralized system. The Phase II drill program, which is expected to be completed by year-end, will continue to test this area.”

Notes:

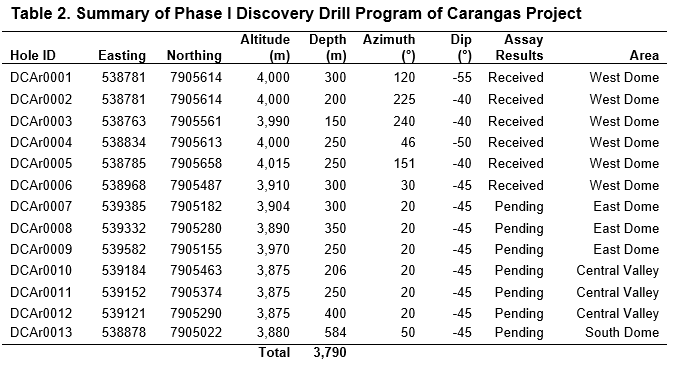

Drill location, altitude, azimuth and dip of drill holes are provided in Table 2.

Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data.

Calculation of silver equivalent (“AgEq”) is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are US$22.50/oz for silver (“Ag”), US$0.95/lb for lead (“Pb”), US$1.10/lb for zinc (“Zn”), and US$3.40/lb for copper (“Cu”). The formula used for the AgEq calculation is as follows: AgEq= Ag grams per tonne (“g/t”) + Pb g/t * 0.0029 + Zn g/t * 0.00335 + Cu g/t * 0.01036. This calculation assumes 100% recovery. Due to the early stage of the Project, the Company has not yet completed metallurgical test work on the mineralization encountered to date.

A cut-off of 20 g/t AgEq is applied for calculation of length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts. Future ongoing test work is contingent on the success of the exploration program. The results outlined in this table do not guarantee a specific outcome.

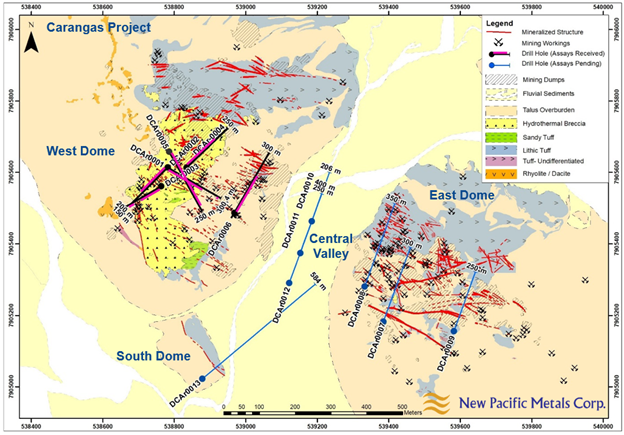

The Phase I discovery drill program consisted of 3,790 metres (“m”) drilled in 13 drill holes (Table 2), testing the West Dome, East Dome, Central Valley, and South Dome targets. All 13 drill holes intersected thick intervals of predominantly structurally controlled (with or without disseminations) polymetallic mineralization, defining a mineralized area approximately 1,000 m long by 700 m wide and up to 400 m in depth (Figure 1).

The West and East Dome zones are comprised of outcropping mineralized volcanic breccia and/or altered lithic tuff cut by mineralized fracture zones associated with widespread historical mining workings.

The Central Valley Zone sits between the West and East Domes and is covered by recent fluvial sediments, which range from a few metres up to 40 metres of thickness (Figure 1). The most recent drill assays provide initial results from the East Dome and Central Valley targets.

Encouraged by results to date, two additional drill rigs were mobilized to site, for a total of three, to compete the Phase II drill campaign (for details please refer to the Company’s news release dated October 26, 2021). Additional assay results will be provided upon receipt.

Drilling Continues to Intersect Thick Zones of Silver Mineralization

EAST DOME

Three drill holes, DCAr0007, DCAr0008 and DCAr0009, were drilled to the north-east at -45 degrees, testing the East Dome target. All drill holes returned broad zones of silver-rich polymetallic mineralization. Numerous mined-out voids, which historically exploited outcropping higher-grade veins / structures at depth, were intersected, suggesting that the drill holes may be under-reporting the true average grades of the mineralized intervals. Future drilling will test the East Dome target at depth.

Drill hole DCAr0007 was collared midway on the western slope of East Dome and intercepted a 220.51 m interval at a grade of 49 g/t AgEq (19 g/t Ag, 0.30% Pb, 0.62% Zn, and 0.01% Cu), including a higher-grade sub-interval of 40.13 m at a grade of 125 g/t AgEq (29 g/t Ag, 0.74% Pb, and 2.21% Zn). An aggregate length of 13.34 m of historical mined-out zones (zero core recovery) was intersected. Mineralization continues at the end of the drill hole (300 m) but systematical sampling only occurred to 220.51 m depth. The Carangas technical team is currently sampling the lower portions of the drill hole.

Drill hole DCAr0008 was collared in the lower western slope of East Dome and intercepted a 236.81 m interval at a grade of 64 g/t AgEq (31 g/t Ag, 0.28% Pb, 0.72% Zn, and 0.01% Cu), including two higher-grade sub-intervals of 17.72 m at a grade of 194 g/t AgEq (96 g/t Ag, 0.84% Pb, 2.15% Zn, and 0.01% Cu) and 16.70 m at a grade of 184 g/t AgEq (171 g/t Ag, 0.22% Pb, and 0.19% Zn). Drill hole DCAr0008 encountered 5.23 m of historical mining voids. Similar to drill hole DCAr0007, mineralization continues at the end of the drill hole with systematical sampling stopping at 250.38 m. The Carangas technical team is currently sampling the lower portions of the hole.

Drill hole DCAr0009 was collared near the top of East Dome and intercepted a 52.91 m interval at a grade of 49 g/t AgEq (30 g/t Ag, 0.52% Pb, 0.08% Zn, and 0.01% Cu). The majority of the drill hole is geochemically anomalous and, based on the current geological model, is interpreted to represent the distal / upper portions of the large mineralized system.

Based on results to date, mineralization (thickness and grade) increases towards the Central Valley Zone.

Please refer to Figure 1 below.

CENTRAL VALLEY

The first two drill holes completed in the Central Valley Zone, DCAr0010 and DCAr0011, were drilled to the north-east at -45 degrees and returned long mineralized intercepts, which start immediately below semi-consolidated younger fluvial sediments. In general, both drill holes returned thicker and broadly higher average grade intervals compared to the East Dome drill holes, which suggests that they may be closer to the hydrothermal source.

The results demonstrate that the mineralized structures mapped and intersected in the West and East Dome zones continue below younger cover in the Central Valley Zone. Based on current data, these structures are expected to form a large geological contiguous silver-rich polymetallic system. It is anticipated that future assay results will continue to support this working geological model.

Drill hole DCAr0010, the first hole to test the Central Valley target, intercepted a 98.01 m interval at a grade of 98 g/t AgEq (43 g/t Ag, 0.41% Pb, 1.2% Zn, and 0.02% Cu) from bedrock at 61.69 m downhole (with depth 0.00 m to 61.69 m comprised of fluvial sediments). The drill hole terminated in a weakly altered basaltic dyke cut by sparse mineralized veinlets.

Drill hole DCAr0011 collared approximately 100 m to the south of drill hole DCAr0010, intercepted a 176.77 m interval at a grade of 94 g/t AgEq (44 g/t Ag, 0.39% Pb, 1.07% Zn, and 0.03% Cu), including a higher-grade sub interval of 60.45 m at a grade of 169 g/t AgEq (84 g/t Ag, 0.61% Pb, 1.86% Zn, and 0.04% Cu). The drill hole terminated in mineralization. Fluvial sediments are present from 0.00 m to 73.23 m.

Please refer to Figure 1 below.

Figure 1. Simplified geology plan map and drill holes of the Phase I discovery drill program at the Carangas Project

Notes:

Drill collar coordinate system is UTM Zone 19S.

Coordinate of drill collar is picked with handheld GPS, subject to minor modification when resurveyed with Real-Time Kinematic GPS upon completion of the drilling program.

QUALITY ASSURANCE AND QUALITY CONTROL

All samples in respect of the exploration program at the Carangas Project, conducted by the Company and discussed in this news release, are shipped in securely-sealed bags by New Pacific staff in the Company’s vehicles, directly from the field to ALS Global in Oruro, Bolivia for preparation, and ALS Global in Lima, Peru for geochemical analysis. ALS Global is an ISO 17025 accredited laboratory independent from New Pacific. All samples are first analyzed by a multi-element ICP package (ALS code ME-MS41) with ore grade over specified limits for silver, lead and zinc further analyzed using ALS code OG46. Further silver samples over specified limits are analyzed by gravimetric analysis (ALS code of GRA21). Certified reference materials, various types of blank samples and duplicate samples are inserted to normal drill core sample sequences prior to delivery to laboratory for preparation and analysis. The overall ratio of quality control samples in sample sequences is around twenty percent.

QUALIFIED PERSON

The scientific and technical information contained in this news release has been reviewed and approved by Alex Zhang, P. Geo., Vice President of Exploration, who is a Qualified Person for the purposes of National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”). The Qualified Person has verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company with precious metal projects, including the flagshipSilver Sand Project, the Silverstrike Project and the Carangas Project, all of which are located in Bolivia. The Company is focused on progressing the development of the Silver Sand Project, while growing its Mineral Resources through the exploration and acquisition of properties in the Americas.

For further information, please contact:

Stacey Pavlova, CFA

VP, Investor Relations and Corporate Communications

New Pacific Metals Corp.

Phone: (604) 633-1368

U.S. & Canada toll-free: 1-877-631-0593

E-mail: info@newpacificmetals.com

www.newpacificmetals.com

To receive company news by e-mail, please register using New Pacific’s website at www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to: statements regarding the anticipated timing, amount and completion of exploration, drilling, development, construction, and other activities or achievements of the Company; the Phase II Drill Program and anticipated outcomes therefrom; future economics of the Company’s projects; timing of receipt of permits and regulatory approvals; estimates of the Company’s revenues and capital expenditures; and other future plans, objectives or expectations of the Company.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada; risks associated with community relations and corporate social responsibility, and other factors described under the heading “Risk Factors” in the Company’s Annual Information Form and its other public filings.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information.

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company’s ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in Bolivia; the Company’s ability to obtain and maintain social license at its mineral properties; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits, including the ratification and approval of the Mining Production Contract with COMIBOL by the Plurinational Legislative Assembly of Bolivia; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

CAUTIONARY NOTE TO US INVESTORS

This news release has been prepared in accordance with the requirements of NI 43‐101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. Securities laws. NI 43‐101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.